The Canadian dollar ended the trading week on a positive note with help of supportive macroeconomic releases from Canada, which showed that the economy performs rather well and may weather monetary tightening from the nation’s central bank. Canada’s Consumer Price Index rose 2.4 percent in June from a year ago, the fastest rate of growth in more than two years. Month-on-month, consumer prices grew 0.3 percent on a seasonally adjusted … “Canadian Dollar Ends Week on Positive Note”

Month: July 2014

Euro Breaches $1.35 for First Time Since February, Recovers

The euro breached the $1.35 level for the first time since February yet was able to recover and close flat versus the US dollar, though it still ended the week with losses. The currency gained on some other majors, including the Japanese yen and the Great Britain pound. While the euro was under pressure from risk aversion initially, the currency managed to recover after risk aversion. Of course, concerns about the economic health … “Euro Breaches $1.35 for First Time Since February, Recovers”

UK Pound Pauses After Gains Earlier This Week

UK pound is pausing today, looking for consolidation at the end of this week after solid gains driven by encouraging economic data. More strength is expected for the sterling going forward, especially against the euro, thanks to the improving economic picture. So while the pound is lower today, it is likely to strengthen in coming weeks. Sterling has been doing pretty well this year, including a rally performance earlier … “UK Pound Pauses After Gains Earlier This Week”

US Dollar Continues to Gain on Expectations

US dollar index is higher today as the greenback continues to gain on expectations for improvement in the economy. With Janet Yellen’s upbeat assessment earlier this week, even slightly mixed data can’t dampen the spirits of those that think the US dollar will soon gain strength as the Fed reduces is easing efforts. Greenback is higher against most of it major counterparts today, gaining on expectations that the Federal Reserve … “US Dollar Continues to Gain on Expectations”

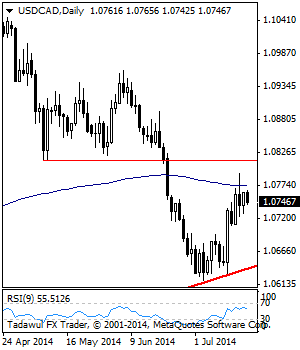

USDCAD: Vulnerable, Faces Corrective Pullback

USDCAD: Having continued to hold below the 1.0793 level, our bias remains lower on pullbacks. On the downside, support is seen at the 1.0600 level where a break will aim at the 1.0550 level. Further down, support comes in at the 1.0500 level and then the 1.0450 level. On the upside, resistance resides at the … “USDCAD: Vulnerable, Faces Corrective Pullback”

Yen Backs Off After Risk Aversion Fades

The Japanese yen declined today, following the three-day rally against the euro, as the Forex market calmed after the initial surge of risk aversion and safe assets started to lose their value that they have gotten with risk premium. While geopolitical concerns are still weighing negatively on some riskier currencies, safer ones are not necessary find the same demand as at yesterday’s trading session. It looks like FX … “Yen Backs Off After Risk Aversion Fades”

Malaysian Ringgit Suffers from Geopolitical Risks

The Malaysian ringgit dropped today, leading other Asian currencies in decline, as geopolitical tensions made Forex market traders reluctant to buy riskier assets of emerging markets. Things are not quiet around the world, and this means that risk-associated currencies are not in favor. The crash of the Malaysian passenger aircraft over Ukraine and speculations about who caused the tragedy worsened the already heated situation in Eastern European nation. Meanwhile, Israel … “Malaysian Ringgit Suffers from Geopolitical Risks”

Ruble Drops on Additional Sanctions

The Russian ruble dipped today as the United States and the European Union implemented sanctions against Russian companies that may lead to recession in the Eastern European nation. The USA decided to intensify sanctions against Russia for its involvement in the Ukrainian crisis, and the list of affected companies included such giants as Rosneft and Novatek. Some analysts believe that such measures may result in economic recession in Russia, while others argue that perhaps the country’s … “Ruble Drops on Additional Sanctions”

No Interest Rate Hike Means Weaker Brazilian Real

The Brazilian real crashed today after the nation’s central bank refrained from raising interest rates, the move that led to speculations that there will be no more rate hikes in Brazil this year. The Central Bank of Brazil left its key Selic rate at 11 percent during yesterday’s policy meeting. While the bank said in the statement that the rate remains stable “at this moment”, swap trading revealed … “No Interest Rate Hike Means Weaker Brazilian Real”

Eurozone Inflation Remains in the “Danger Zone”

The eurozone’s inflation rate remains in what the ECB refers to as the “danger zone,” a situation that hasn’t surprised anyone. However, the ongoing problems with the eurozone economy continue to provide fuel for speculation that policymakers will be forced to take more drastic steps to boost the economy. This is once again creating a situation in which the euro struggles against some of its counterparts. Today, Eurostat reports that consumer prices for the month … “Eurozone Inflation Remains in the “Danger Zone””