The USD made yet another move higher across the board yesterday after the FOMC meeting minutes, while stocks also found some support. However, the latest leg of the USD against the majors is extended and can be a final one within a larger impulsive price action. So, traders must be aware of trend reversals.

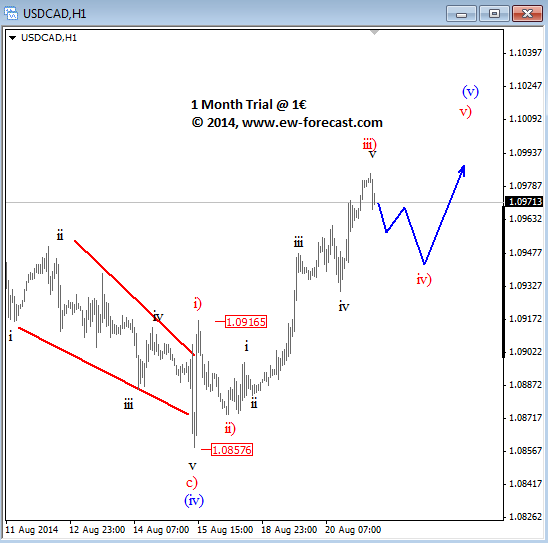

On EURUSD we have been looking down to 1.3250/65 in the last few days. A target that has been reached a few sessions back. In fact, a decline from 1.3410 can be counted in five waves, so a bounce may follow soon; a bigger one if we consider that the latest leg down is wave (v). However, only price can confirm the count, so we need to see 1.3296 broken to confirm a temporary change in trend. Generally speaking, EURUSD is still bearish, but because of a very deep price and because of the wave structure we do not see it in good position for any new shorts, not even longs.

EURUSD 1h Elliott Wave Analysis

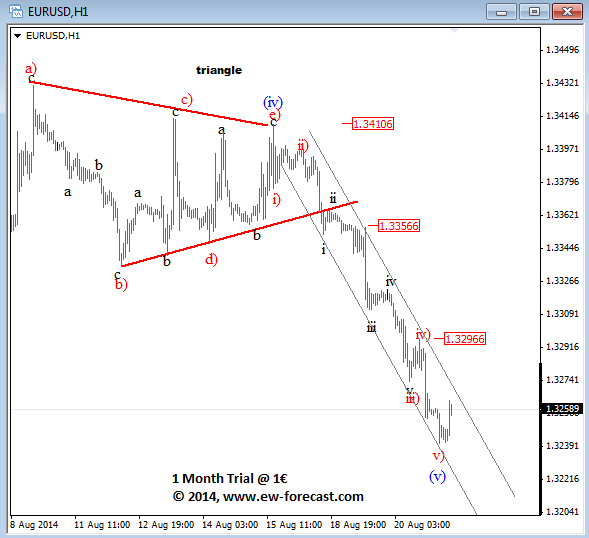

USDCAD is also on the move this week, away from 1.0857 where we labeled the end of wave (iv), so a rally should unfold in five waves. Well, a new high has already been achieved, so the upside in wave (v) can be limited. We are looking at 1.1000 as potential resistance. In the mean-time, any set-back to 1.0930/1.0940 should be corrective.

USDCAD 1h Elliott Wave Analysis