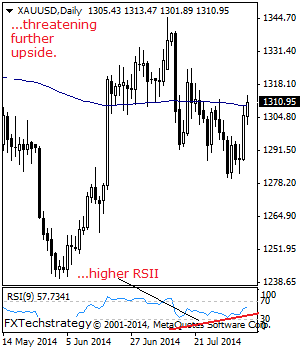

GOLD: With GOLD reversing intra day losses to close strongly higher on Wednesday and following through higher during Thursday trading session, further bullish offensive is likely. On the upside, resistance resides at the 1,330.00 level where a break will target the 1,345.90 level followed by the 1,345.90 level. A cut through here will extend gains … “GOLD: Threatens Further Upside”

Month: August 2014

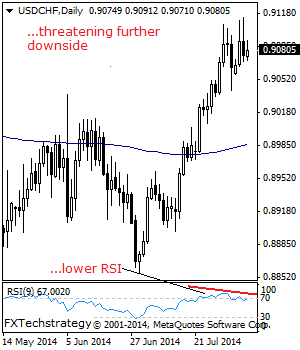

USDCHF: Loses Bullish Steam, Vulnerable

USDCHF: With USDCHF turning lower off higher level prices to close lower on Wednesday, further downside is expected. On the downside, support lies at the 0.9000 level with a break targeting the 0.8950 level. A cut through here will target the 0.8900 level where a violation will open the door for more weakness towards the … “USDCHF: Loses Bullish Steam, Vulnerable”

Japanese Yen Settled Down After Earlier Gains

Japanese yen is mostly lower again, following a brief surge earlier. Thanks to a temporary demand for safe haven assets, as well as stop-loss order executions earlier, the yen saw a brief surge. Now, though, the yen is settling down, and is mostly lower. Earlier, the yen saw some rather dramatic gains. Part of it was due to safe haven demand. It appears that matters are spiraling out … “Japanese Yen Settled Down After Earlier Gains”

Loonie Gains Against European Counterparts

Canadian dollar is heading a little higher this week, gaining ground against European counterparts, thanks in large part to the latest trade surplus data. With the Canadian dollar looking for gains related to its economic recovery, and with Europe suffering from economic difficulties and geopolitical uncertainty, it’s no surprise the loonie is gaining. The latest trade data from Canada showed a surplus of C$1.86 billion in the month of June. Canada … “Loonie Gains Against European Counterparts”

USD/CAD: Trading the Canadian Jobs Aug 2014

Canadian Employment Change is an important leading indicator which can have a significant impact on the movement of USD/CAD. A reading which is higher than forecast is bullish for the Canadian dollar. Here are the details and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 GMT. Indicator Background Job creation is one of the most important leading … “USD/CAD: Trading the Canadian Jobs Aug 2014”

Russian Sanctions add to deflationary pressures on the euro-zone

Russia announced a ban on food imports from the European Union, the US and other countries in retaliation to the sanctions imposed on it earlier. The tension around the Ukraine crisis may have already taken its toll on the euro-zone, but now it could significantly worsen. A ban on food exports to Russia means an … “Russian Sanctions add to deflationary pressures on the euro-zone”

How to Trade Forex Like Bill Lipschutz

We all want to be successful traders, so it pays to look at those who have really made their mark in the forex market. If you want to find an example of a trader who has really hit it big, then look no further than Bill Lipschutz, founder of Heathersage Capital Management. Like many traders, … “How to Trade Forex Like Bill Lipschutz”

Disappointing Economic Data Weighs on Euro

Euro is heading lower today, thanks in large part to the disappointing economic data released earlier. Also impacting the euro is the geopolitical situation, which brings with it a great deal of uncertainty right now. The latest economic data out of Germany is somewhat disappointing. German factory orders dropped 3.2 per cent from May to June, constituting the biggest drop since 2011. Germany is a major player … “Disappointing Economic Data Weighs on Euro”

EURUSD: Extends Downside Pressure

EURUSD: With EUR reversing its recovery gains to close lower on Tuesday and following through lower during Wednesday trading session, it now faces further downside pressure. Support lies at the 1.3300 level where a break will expose the 1.3250 level. Below here will pave the way for a move lower towards the 1.3200 level. If … “EURUSD: Extends Downside Pressure”

AUD/USD: Trading the Australian jobs Aug 2014

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian employment market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one of … “AUD/USD: Trading the Australian jobs Aug 2014”