The Japanese yen gained today with help of the general risk-negative market sentiment and good economic data from Japan itself. The currency gained for a second consecutive session against the US dollar and for a third session versus the euro. The Forex market continues to favor safer currencies as geopolitical tensions in Eastern Europe and Middle East make traders averse to risk. Such sentiment was driving the yen up yesterday and continues to benefit the currency today. … “Market Sentiment Helps Yen Maintain Rally”

Month: August 2014

Wage growth still an issue for the BoE

Janet Yellen stated that even though recent labour market data (unemployment rate: 6.2%) shows improvement, there still exists spare capacity in the economy. Thus, we expect the Fed will introduce the interest rate hike in mid-2015 due to an improving labour market and to combat rising inflation. In addition, more data is required to justify … “Wage growth still an issue for the BoE”

Euro Struggles on Easing Expectations

Even though the euro is higher against some of its major counterparts, the 18-nation currency is struggling today. Euro has slipped lower against the US dollar, and is barely holding its own against the UK pound. Expectations that the ECB could ease policy further next week are weighing. There is speculation, following comments made by Mario Draghi in Jackson Hole, Wyoming over the weekend, that … “Euro Struggles on Easing Expectations”

NZD/USD Falls to Lowest Since February on Trade Deficit

The New Zealand dollar declined today after the nation’s trade balance demonstrated a bigger deficit than was expected by analysts. The currency reached the lowest rate since February against its US counterpart. New Zealand’s trade balance showed a shortage of NZ$692 million in July, compared to the median forecast of NZ$475 million. It was the first deficit in nine months. The kiwi sank against the greenback after the report, but recovered later … “NZD/USD Falls to Lowest Since February on Trade Deficit”

UK Pound Continues to Struggle

UK pound continues to struggle in Forex trading today, thanks in large part to the fact that the economic data isn’t holding up, and Bank of England policymakers don’t seem to be on the same page. Sterling is struggling today, down against its major counterparts, thanks in large part to the latest economic news out of the United Kingdom. The latest figures for July inflation show a slowing for the United Kingdom, which means the economy isn’t … “UK Pound Continues to Struggle”

How to trade forex like Van K. Tharp

As one of the top psychology coaches for traders around the globe, Van K. Tharp knows first-hand what separates the top traders from the rest of the bunch. Tharp has been in the business for many years and has released a number of best-selling trading books including “Trade Your Way to Financial Freedom”, “Trading Beyond … “How to trade forex like Van K. Tharp”

Dollar Pares Gains After Opening Sharply Higher

The US dollar declined today against its most-traded peers, yet it is important to understand that the currency opened sharply higher, meaning that it still trades above the last week’s closing rate against most majors. The hawkish Federal Reserve minutes as well as the relatively balanced stance of Chairperson Janet Yellen allowed the dollar to surge. While the currency lost its gains versus the Great Britain pound, returning … “Dollar Pares Gains After Opening Sharply Higher”

Bank of Israel Cuts Main Interest Rate to Record Low

The Bank of Israel surprised the Forex market today, cutting its benchmark interest rate unexpectedly, following the same move in the previous month. This led to a huge slump of the Israeli shekel. The BoI cut its main interest rate by 25 basis points to the record low of 0.25 percent today, making a huge surprise to analysts, who have expected the central bank. The central bank made the same interest rate cut in July. The bank … “Bank of Israel Cuts Main Interest Rate to Record Low”

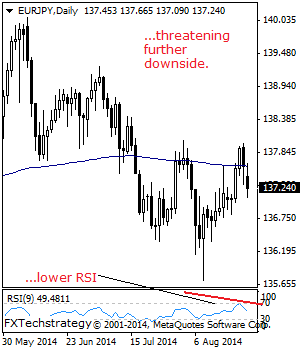

EURJPY: Declines, Faces Further Pullback Risk

EURJPY- With a follow through lower seen on the back of its Friday weakness today, more decline is now envisaged. Support comes in at the 137.00 level where a break will aim at the 136.50 level. A break will target the 135.72 level with a breach turning focus to the 135.00 level. Below here will … “EURJPY: Declines, Faces Further Pullback Risk”

Yen Profits from Risk Aversion

The Japanese yen profited from the risk-negative market sentiment, rising against its major counterparts. The currency opened sharply lower versus the US dollar but was able to slowly rise, though it still trades below the Friday’s close. The Japanese yen, being considered a relatively safe investment option, gained with the help of the risk-aversion market sentiment, created by last week’s comments from the Federal Reserve. Of course, this also … “Yen Profits from Risk Aversion”