And if the answer is yes, could we see the dollar resume its rally once her speech is released? Let’s see the case for a dovish Yellen and why this may already be priced in: Update: Yellen provides no new message – USD stronger The case for a dovish Yellen Yellen is a known dove and her view … “Is a dovish Yellen already priced in?”

Month: August 2014

Market Movers Episode #12: The Fed, the economy and

Welcome to a new episode of Market Movers, presented by Lior Cohen of Trading NRG and Yohay Elam of Forex Crunch.You are welcome to listen, subscribe and provide feedback. In today’s episode, we focus on the Fed and its huge impact on financial markets, currencies and commodities: Post crisis Fed action: we review what the Fed has … “Market Movers Episode #12: The Fed, the economy and”

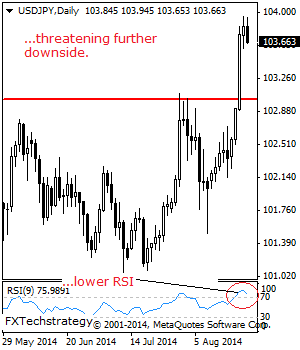

USD/JPY: Triggers Corrective Pullback

USDJPY: Although maintaining its broader uptrend, USDJPY faces corrective pullback threats. Resistance resides at the 104.00 level where a break will target the 104.50 level. Further out, resistance comes in at the 105.00 level where a violation will aim at the 105.50 level and possibly higher towards the 106.00 level. On the downside, support comes … “USD/JPY: Triggers Corrective Pullback”

Re-Evaluating Labor Market Dynamics at Jackson Hole Symposium

One of the world’s most important economic symposiums is held annually in Jackson Hole, Wyoming. This major event will be the focus of many influential central bankers, finance ministers and other financial professionals over the next three days. Update: Yellen provides no new message – USD stronger The Kansas City Federal Reserve’s Jackson Hole Economic Symposium … “Re-Evaluating Labor Market Dynamics at Jackson Hole Symposium”

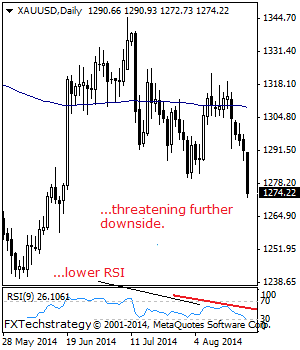

GOLD: Sells Off Sharply

GOLD: With continued downside pressure seen, GOLD extended its weakness during Thursday trading session. Support lies at the 1,257.68 level where a break will aim at the 1,230.00 level. A break will target the 1,200.00 level with a violation turning attention to the 1,180.00 level. Below here will expose the 1,160.00 level and then the … “GOLD: Sells Off Sharply”

US Data Keeps Dollar Strong

Economic data from the United States allowed the US dollar to rally against its major peers, including the Great Britain pound and the Japanese yen, yesterday and to maintain gains today. The currency fell against the euro but not before reaching the highest price since September. A range of US macroeconomic indicators was released yesterday, and all of them were positive. The data followed the hawkish Federal Reserve minutes that were released … “US Data Keeps Dollar Strong”

UK Retail Sales Make Life Harder for Sterling Bulls

The Great Britain pound fell a bit today after retail sales missed forecasts, reinvigorating concerns about Britain’s economic growth. The losses were limited though, and the sterling managed to gain ground as the monetary policy outlook supported the currency. UK retail sales were up just 0.1 percent in July, while analysts promised 0.4 percent growth. The data made the sterling extend yesterday’s drop against the dollar. While Britain’s … “UK Retail Sales Make Life Harder for Sterling Bulls”

Aussie Recovers After Big Drop

The Australian dollar dipped today after manufacturing data from China disappointed traders. Yet for whatever reason the currency was able to erase the big drop and trades near the opening level right now. The HSBC Flash China Manufacturing Purchasing Managersâ Index dropped from 51.7 in July to 50.3 in August — the lowest level in three months. While the index remained in an expansionary territory, it is dangerously close to the neutral 50.0 level … “Aussie Recovers After Big Drop”

EUR/USD: Trading the US Unemployment Claims Aug 2014

US jobless claims are released weekly and serve as a constant barometer for the health of the job market. Despite the volatile nature of the frequent report, it has a significant impact on the dollar, especially as the figures have recently dropped several times below the 300K mark, indicating a break from the previous range and … “EUR/USD: Trading the US Unemployment Claims Aug 2014”

Is the USD move against EUR and CAD over-extended?

The USD made yet another move higher across the board yesterday after the FOMC meeting minutes, while stocks also found some support. However, the latest leg of the USD against the majors is extended and can be a final one within a larger impulsive price action. So, traders must be aware of trend reversals. On … “Is the USD move against EUR and CAD over-extended?”