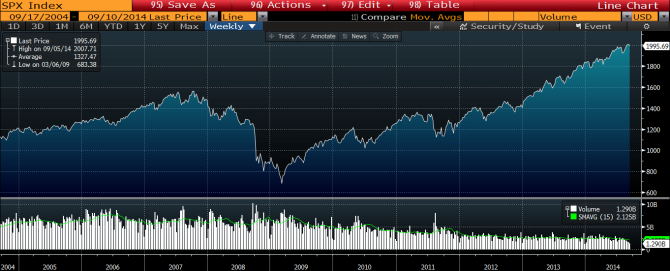

Equities are clearly at or near their all time highs. Remember taking the roller coaster? The part where you slowly go higher and higher is the scariest isn’t it?

Historically, Bullion is a hedge against inflation, as well as an indicator of risk aversion. Which is why in the chart below, Gold continued to stay bullish even while equities took a dive in the 2007-2008 recession. What caught our attention on the Gold chart was the potential triple bottom, which is a very strong bullish signal.

S&P 500 Index

NASDAQ Index

Malaysia Equities

Indonesia Equities

Singapore Equities

Gold Index

At Streetpips.com we research profitable forex strategies based on price action, regardless of which way markets turn. While we do not actively keep abreast of what goes on around global markets, sometimes it is just fun to know what’s going on, and today is one of those days.

Guest post by Streetpips.com

What is the Triple Bottom Price Pattern?

A triple bottom is a reversal pattern with bullish implications, composed of three failed attempts at making new lows in the same area, followed by a price move up through resistance. This pattern is rare, but a very reliable buy signal. In the chart above we see Gold prices hitting the $1,200 support level twice, and is approaching it again. A failed break the 3rd time followed by a bullish break above $1,400 would be a very bullish signal, painting the famous Triple Bottom price pattern.

Increasing Market Risks

In addition to property and credit bubbles we see globally, there is heightened geopolitical risks as we have seen between Russia/Ukraine, Israel/Gaza, the ISIS group in Iraq and Tokyo/Beijing. Central banks are doing a good job numbing market investors to mounting political risks – the excessive liquidity may be causing some complacency in equities/debt markets.

The above could all gel together with escalating market risks, a correction in equities markets and a triple bottom bullish move in Gold.

*All charts sourced from Bloomberg.