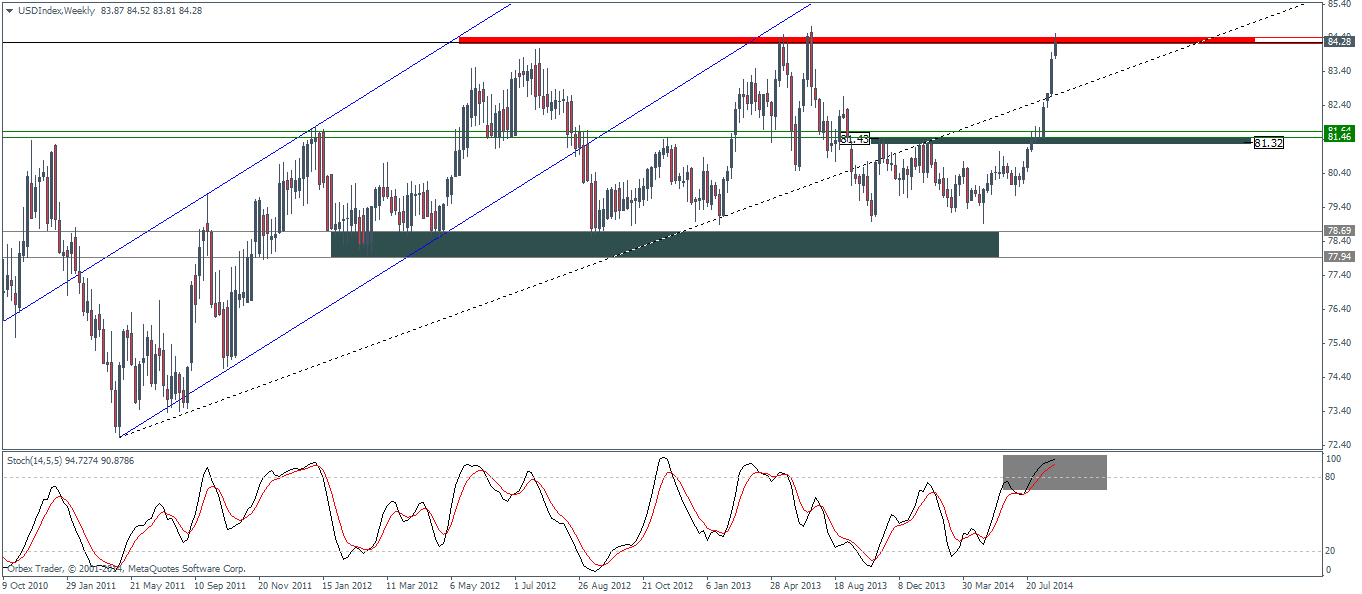

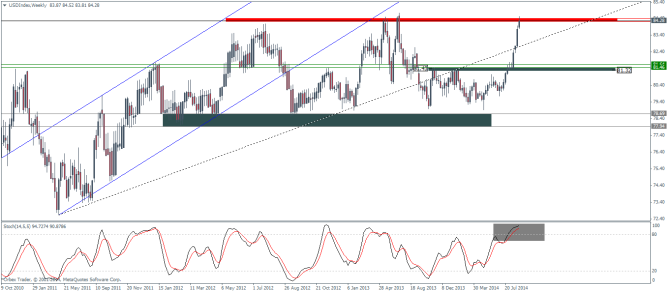

The US Dollar Index, a currency weighted index has enjoyed its bullish rally since May gaining momentum ever since. The Dollar Index however is currently at 84.27 which incidentally happen to be a key resistance level in the past and showing signs of weakness already. The resistance level previously saw some heavy selling with the weekly charts showing a previous bearish engulfing candle formed around the week of 7th July (FOMC Minutes).

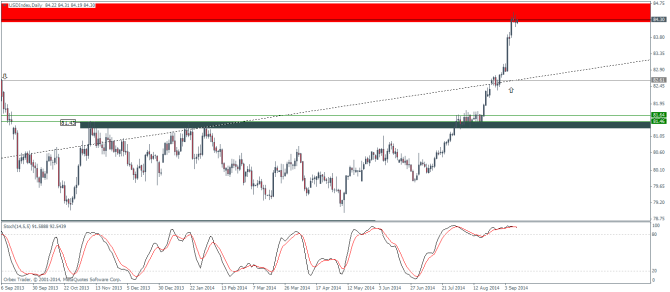

When switching to the daily chart interval, we notice the Stochastics also confirming the Dollar Index is in an extremely overbought level pointing to a possible correction. The most evident support level lies at the region of 81 and 82.6, but for this to happen; it would take an extremely dovish view from the FOMC meeting due on September 17th.

Considering the adage, buy the rumor, sell the fact; it wouldn’t be too surprising to learn that the markets may have gotten ahead of themselves riding on the various reports and comments coming out from the various Fed officials. However, the main aspect that cannot be ignored is that the Fed will continue to wind down its QE purchases this month with the final tapering to end next month in October. This would only put pressure on the Federal Reserve to start talking about possible rate hike guidance.

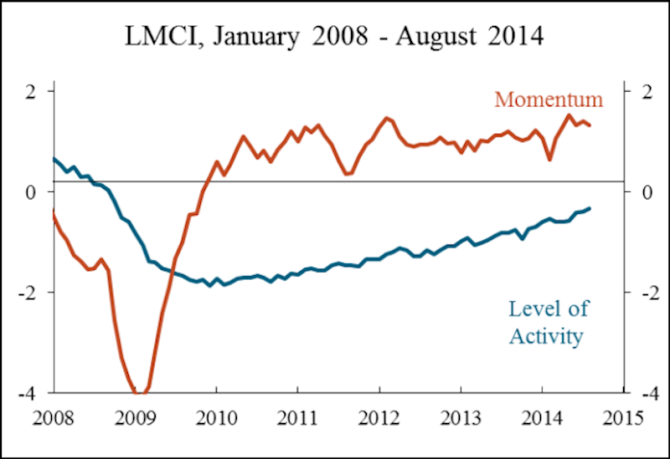

So far, the markets are expecting to see some hawkish stance by the Fed Chair Janet Yellen. A little known indicator, the Labor Market Composite Index (LMCI), which tracks different variables of the labor market, was released yesterday by the Kansas City Fed which showed that the labor market momentum continues to remain at historically high levels, building a case for the Fed to start looking into the rate hike path.

Source: Kansas City Fed

Further fuelling speculations was the reports by the San Francisco Federal Reserve that the general public expects to see a slower rate hike compared to the Fed officials. This has triggered rumors that the FOMC could change the tone of its monetary policy this September 17th and provide hints on the interest rate hike guidance. The markets at this point expect US interest rates to start rising around June 2015, with a gradual rate hike later in October next year.

With the US Dollar Index, now sitting at a key resistance level, it would be interesting to see how things will shape out. A bullish USDX is likely to be fuelled by the FOMC minutes next week, ahead of which the monthly retail sales figure is likely to be the only market moving event in regards to the Dollar Index. Failure to close above the resistance with the oscillators in the overbought levels is likely to pose some risks to the Greenback next week. Any downside corrections could be viewed as a possible opportunity to add to USD long positions as the overall long term view of the Greenback is very bullish.