For a currency that enjoyed one of the strongest rallies earlier this year, the GBPUSD has been consistently declining over the past few months and even more so during the run up to the Scottish vote. Most traders would have seen these declines as an opportunity to buy the Cable but short term technical analysis points to a bearish picture with no signs of a reversal to the short term downtrend in sight.

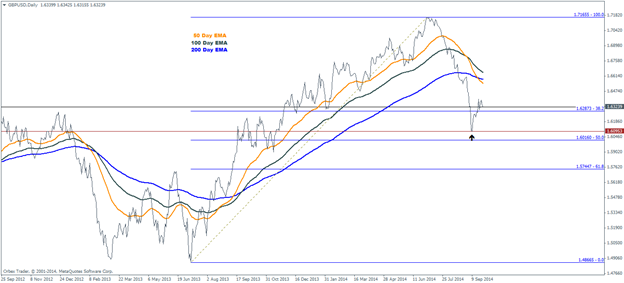

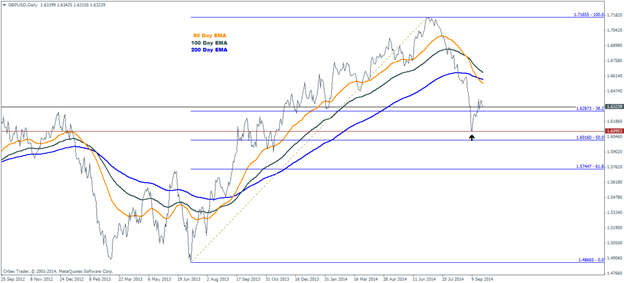

Make no mistake, the GBPUSD from the daily and weekly chart intervals is perfectly still in an uptrend. The decline in GBPUSD also looks to have hit rock bottom right near the 38.2% Fibonacci level after a sharp reversal near 1.60953, falling with the previous support and resistance level and one which has seen a bit of consolidation on the leg up. Technically, GBPUSD is trading below its 200 day EMA while recently the 50 day EMA cut below the larger moving average. The 100 day EMA is still above the 200 EMA, which could hint towards a confirmation of this corrective move more than anything else.

The Stochastics oscillator (not shown on chart) is pointing straight up moving out from its oversold levels since the reversal in the 38.2% Fib zone.

From a fundamental point of view the UK is in a good economic position as most of the fundamental indicators point to a steady growth as outlined in the table below.

| GDP Annual Growth Rate | 3.2% |

| Unemployment Rate | 6.2% |

| Inflation | 1.5% |

| Core Inflation | 1.9% |

The markets were earlier expecting the BoE to raise interest rates at its November 2014 meeting, but have later pushed the BoE rate hike expectations towards the second quarter of 2015. This was also reiterated by BoE’s Governor Carney at the recent inflation hearing report where he had specified that the BoE could raise rates as early as spring next year.

One of the important factors to consider in relation to the US Dollar being that the recent FOMC minutes were dovish while future projections were seen to be very hawkish. However, Yellen has reiterated time and again that the easy money policy would be data driven, in other words nothing is set in stone.

Comparing the Fed’s rhetoric to that of the BoE’s, with a continued improvement in the labor market (albeit the issues of slack and wage growth), the overall fundamentals in the UK do point to a positive outlook, with a small margin for an earlier than hinted rate hike rise. With Central bankers now using any opportunity available to them to verbally intervene in the currency markets, the GBPUSD will most likely be driven by interest rate expectations at the risk of being influenced in the short term by speeches.

This week, the US Q2 GDP data will be revised and it looks very bullish with analysts expecting an increase to 4.6% from the previous 4.2% growth. Although the expectations are on the higher end of the scale, actual print in line with expectations could drive the US Dollar to new highs across the board. With only a few days left for September to close, the week after will see a flow of economic data with key events such as the US NFP for September, PMI data from the UK and GDP & inflation prints. Regardless of how the individual data comes out, taken as a whole could provide some fundamental clues on which of the two Central banks is going to start raising the interest rates first.