Technical Bias: Bearish Key Takeaways New Zealand dollar struggling to hold the ground against the US dollar and looks set for further losses in the near term. Technical indicators favor downside in the NZDUSD pair. NZDUSD support seen at 0.8310 and resistance ahead at 0.8360. The US dollar gained traction against the New Zealand dollar … “NZD/USD – New Zealand Dollar Remains At Risk For Key”

Month: September 2014

Aussie Keeps Losses After RBA Meeting

The Australian dollar fell against its US peer and the euro ahead of the monetary policy announcement of the Reserve Bank of Australia and maintained losses afterwards. The currency rallied to the highest level in a year and a half versus the Japanese yen but retreated as of now. The RBA kept its key interest rate unchanged at 2.5 percent today. While the central bank noted “improving business conditions and some recovery in household sentiment”, it also mentioned decline … “Aussie Keeps Losses After RBA Meeting”

Fed Policy Outlook Continues to Support US Dollar

The US dollar rose against almost all of its major counterparts today, touching the highest level since January versus the Japanese yen and reaching the strongest rate in a year against euro, as the monetary policy outlook continues to support the currency. The dollar demonstrated remarkable performance in August with help of speculations about eventual monetary tightening from the Federal Reserve. The greenback entered the new trading month with strong upward momentum and for now … “Fed Policy Outlook Continues to Support US Dollar”

Could September be a trend changer for the forex

September is the month when institutional investors traditionally return to their desks following their summer breaks and it’s also a month when trends can change as they make a fresh assessment of the markets. On the face of it equities probably look the most vulnerable to a reassessment. They’ve had a fabulous multi-year bull market … “Could September be a trend changer for the forex”

Indian Rupee Erases Losses

The India rupee retreated today on speculations that the nation’s central bank intervened in order to prevent excessive appreciation of the currency that may hurt the country’s economic growth. The currency managed to pare losses and resumed its rally as of now. The rupee rallied together with Indian stocks as recent economic data from the country was positive. In the second quarter of this year, gross domestic product demonstrated fastest growth in more than two … “Indian Rupee Erases Losses”

USD/RUB Reaches Record High on Sanctions Worries

The Russian ruble fell to the all-time low against the US dollar today as concerns about sanctions from the United States and the European Union continue to erode the attractiveness of the currency to investors. The conflict between Ukraine and Russia that has begun in March with annexation of the Crimean Peninsula continues to this day. This led to sanctions from the USA and the EU, the last of which were implemented just recently. It is expected that these measures … “USD/RUB Reaches Record High on Sanctions Worries”

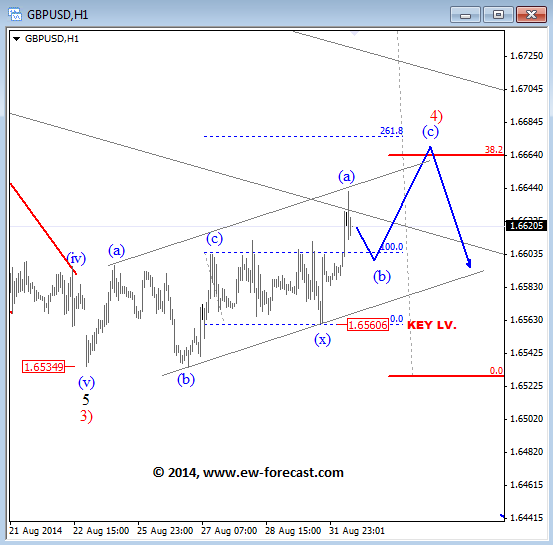

What’s next for EUR/USD and GBP/USD? Elliott Wave Analysis

The USD has extended its gains from last week with EURUSD touching 1.3116. CHF and JPY were also weak against the buck, while AUD, CAD and GBP made some recovery. So generally speaking, we have a mixed USD picture, but larger trends are clear; The US dollar is in bullish mode so any pullbacks within … “What’s next for EUR/USD and GBP/USD? Elliott Wave Analysis”

Market Movers Episode #13: September’s big market movers from

In this episode, we preview the big events that are expected to rock markets in September: Non-Farm Payrolls, the Fed decision, the highly anticipated ECB drama and quite a few other releases that move currencies and commodities. The episode begins with a quick rule of thumb about money management that is always relevant. Welcome to a new … “Market Movers Episode #13: September’s big market movers from”

Forex Crunch Key Metrics August 2014

The summer month of August saw some sort of pickup in forex volatility and therefore a pickup in traffic, despite a usual seasonal slowdown due to summer vacations. Can we be hopeful for even stronger volatility in September? Here are the numbers: Page Views: 486,509. Sessions: 192,845. Users: 84,575. Time on Site: 2:54 Average Pageviews/Visit: 2.52. … “Forex Crunch Key Metrics August 2014”