Russia’s central bank surprised the Forex market today by a huge interest rate hike aimed at cooling inflation and slowing the ruble’s depreciation. Yet the Russian currency did not respond to the announcement, extending its massive slump. The Bank of Russia raised its main interest rate by as much as 1.5 percent to 9.5 percent at today’s meeting, a move completely unexpected by market analysts. The central bank said in the statement: During September-October significant changes … “Bank of Russia Surprises, Ruble Doesn’t Respond”

Month: October 2014

This week in the markets: US ends quantitative easing,

The pound fell heavily against the dollar this week, following the US Federal Reserve’s confirmation of an end to its six year quantitative easing programme and dovish comments from Bank of England’s Deputy Governor regarding UK interest rate rises. Markets were understandably cautious ahead of Wednesday’s FOMC announcement, due to Tuesday’s US durable goods orders. … “This week in the markets: US ends quantitative easing,”

New Japanese Easing Surprises Markets and Sends Yen Lower

In a surprise move, the Bank of Japan announced a new round of easing. Earlier, the yen had been gaining in spite of unfavorable data. Now, though, the yen is heading much lower in the wake of this latest announcement. Japanese data showed disappointing news in terms of unemployment and CPI data earlier. Additionally, household spending was lower. All of the news pointed to slowing growth as the Bank of Japan met for a policy meeting. Even with the unfavorable … “New Japanese Easing Surprises Markets and Sends Yen Lower”

Euro Lower on Quantitative Easing Possibility

Euro is lower against most of its major counterparts today, thanks in part to statements from an ECB policymaker. While quantitative easing isn’t quite on the table, officials aren’t ruling it out, and the possibility of QE, along with other measures meant to weaken the euro in the name of stimulus, is weighing on the 18-nation currency. Earlier, Ewald Nowotny, a policymaker for the ECB and the head of Austria’s central bank, said that quantitative easing wasn’t … “Euro Lower on Quantitative Easing Possibility”

Next Leg Of USD Strength Is Just Around The Corner

The US dollar strengthened after the Fed decision, but the internal data in the GDP report cast some doubt about the strength of the US economy and allowed profit taking on dollar longs. So what’s next for the dollar? Citi sees that the next dollar strength around the corner: Here is their view, courtesy of eFXnews: … “Next Leg Of USD Strength Is Just Around The Corner”

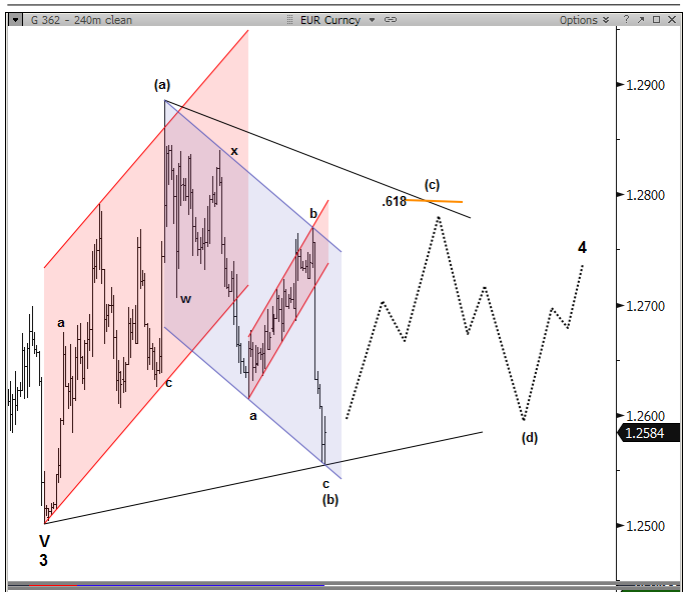

EUR/USD: Larger Triangle; GBP/USD: Wave-5 Target – Nomura

What is the next move for EUR/USD? The team at Nomura sees the pair trading trading in a triangle. For cable, they paint a Wave 5 target. Here is the analysis: Here is their view, courtesy of eFXnews: Yesterday’s sell-off in EUR/USD met Nomura’s 1.2620 target but the break below negated its small bullish triangle … “EUR/USD: Larger Triangle; GBP/USD: Wave-5 Target – Nomura”

Yen Gains Ignoring Unfavorable Data

The Japanese yen gained today even though economic data that came out from Japan during the current trading session was not particularly good. The possible reason for the rally is risk aversion that followed the policy announcement from the Federal Reserve. Both Japan’s and Tokyo core Consumer Price Index fell. The seasonally adjusted unemployment rate rose in September. Household spending declined 5.6 percent in the previous month from … “Yen Gains Ignoring Unfavorable Data”

Dollar Extends Rally on Positive GDP & Jobless Claims Data

The US dollar extended yesterday’s rally today as positive economic data from the United States fueled talks about a possibility of an early interest rate hike from the Federal Reserve. US gross domestic product expanded 3.5 percent in the third quarter of this year. While the growth was below the revised previous quarter’s 4.6 percent, it was still above economists’ expectations of 3.1 percent. The number of initial claims for unemployment … “Dollar Extends Rally on Positive GDP & Jobless Claims Data”

Swiss Franc Appreciates Ahead of Referendum

The Swiss franc erased its earlier losses against the US dollar and gained against the euro today. The Swissie was experiencing upward pressure recently on speculations that possible changes to central bank’s policies might lead to issues with keeping the currency-cap. A referendum will be held in Switzerland on November 30 regarding several changes to policies of the Swiss National Bank, among them a requirement to hold at least 20 percent of assets in gold. … “Swiss Franc Appreciates Ahead of Referendum”

Brazilian Real Jumps After Central Bank Surprises

The Brazilian real jumped today following yesterday’s surprise interest rate hike from Brazil’s central bank. Such decision resulted in speculations that additional rate increases may happen in the future. The Central Bank of Brazil made a huge surprise to market participants yesterday, raising its main interest rate by 25 basis points to 11.25 percent, while no change was expected. The decision was not unanimous as three voting … “Brazilian Real Jumps After Central Bank Surprises”