On one hand, UK unemployment fell in August, but the drop in jobless claims was disappointing. This is only part of the complex picture for GBP. And what’s the next direction?

Deutsche Bank gives two reasons to stay long on sterling:

Here is their view, courtesy of eFXnews:

In a note to clients today, Deutsche Bank outlines a couple of development for sterling advising of staying long GBP despite its recent decline.

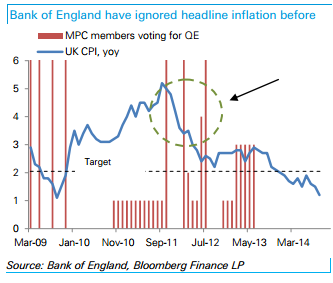

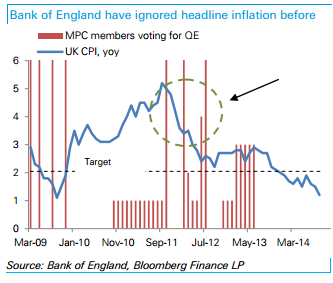

First, while yesterday’s CPI number was weak UK inflation dynamics are very different from the US or Europe. Medium term expectations are stable, services inflation is well supported and lower CPI may actually be beneficial for UK growth in supporting consumption. Headline inflation also matters less for the Bank of England than other central banks.

Second, positioning has moderated yet further. The IMM report shows that the real money community is now the shortest pounds for two years, while hedge funds have continued to cut longs.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.