The European Central Bank battles low inflation, and things become more complicated as the price of oil falls.

And how does it immediately affect EUR/USD? BNP Paribas provides a clear answer:

Here is their view, courtesy of eFXnews:

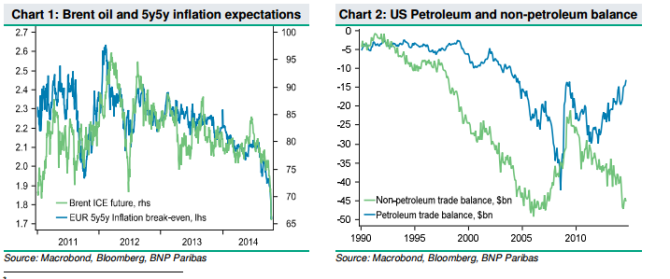

Brent oil has now dropped over 28% from its June peak of USD 115.7/bbl to USD 83.13/bbl with WTI also following suit – down 23.4% to USD 81.76/bbl from USD 104.44/bbl, notes BNP Paribas.

Lower oil prices support a lower EUR/USD

“Lower oil prices support our outlook that policy divergence will drive G10 FX and EURUSD lower. The drop in the oil price will be concerning to the ECB. Despite its growth boosting impact, lower oil prices mean the eurozone inflation situation looks more critical than ever,” BNPP argues.

“When it comes to the FOMC, our view is that the committee is likely to focus on the growth-boosting impact of lower oil prices, particularly in the context of lower US yields. The US, as has been highlighted by our economics team, is facing a tightening labour market. In this context, lower oil prices are likely to be treated as demand-supportive in the US, with the growth boosting impact likely to feed into a more positive Fed view. Oil is increasingly playing less of a role, as the US continues to see its petroleum trade balance narrow,” BNPP adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.