This may not be the perfect time for long positions on the US dollar, says the team at BNP Paribas, even if the medium term outlook is positive.

However, this doesn’t mean they are bullish on the euro, not even in the near term.

Here is their view, courtesy of eFXnews:

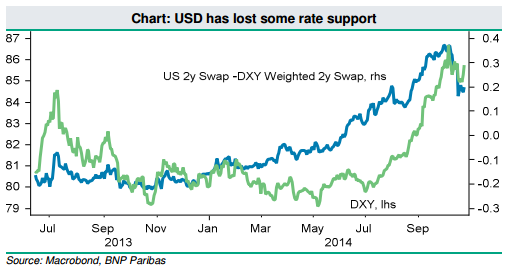

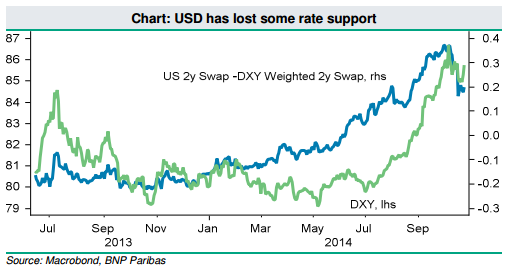

“We remain medium-term USD bulls but are wary of entering new USD long positions at this time. While the risk environment appears to have stabilized this week, this has come with a significant repricing of Fed expectations and loss of yield support for the USD. We expect markets to rebuild Fed pricing only gradually as data confirms progress towards the Feds goals. In terms of this week, we expect the FOMC to end its QE program at its October 29 meeting, in line with the timeframe signalled by Chair Yellen earlier this year.

While we have turned more cautious on the USD, we continue to think the arguments for short-term broad EUR weakness remain sound. Preliminary CPI data for October to be released this week for Germany on Thursday and the eurozone on Friday may show a bounce off the very low y/y rates reported for September.

However, with the levels remaining very low and falling oil prices suggesting more headwinds in Q4, inflation expectations seem unlikely to recover quickly and the ECB will remain under pressure to deliver more aggressive rhetoric at its November 6 meeting. We are running a short EURNZD heading into this week.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.