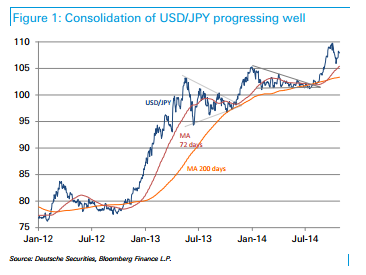

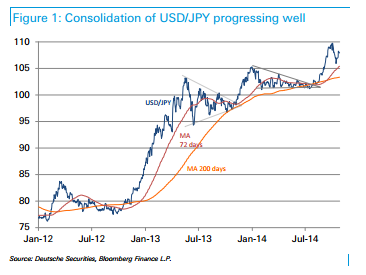

Dollar/yen already peeked above 110, but that was the peak for the time and the pair fell to the 105 handle. Since then, we have seen it advance.

What’s next? The team at Deutsche Bank has a bullish outlook and sees pair make a move in coming weeks. Here is their explanation:

Here is their view, courtesy of eFXnews:

Deutsche Bank sees USD/JPY bulls continuing to be buoyed by the repetition of strong US economic data and monetary policy events in Japan and the US especially as US data is showing positive trends for corporate orders and capex, and for housing.

“USD buying by Japanese investors and importers should continue supporting the USD/JPY, and we see the uptrend continuing to be driven by differences in US and Japanese monetary policy and strong US indicators,” DB argues.

“Our basic view still sees the rate trying to break above 110 again over the coming weeks and reach 112 by the year end, and then rise to 115-120 in 2H 2015,” DB projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.