Euro is falling back now, falling a rally that took place yesterday and in earlier trading. Euro surged higher, especially against the US dollar and the Japanese yen, earlier, but now things are changing. Concerns about risk are back on the table, and lower commodity prices are having their impact. Euro got a boost earlier, thanks to US economic data that disappointed. High beta currencies surged … “Euro Falls Back After Rally”

Month: October 2014

EUR/USD, Cable, SP500: Levels To Targets In Risk-Off –

That was quite a market storm, with violent, volatile moves, and it doesn’t seem to be over. What are the next levels for EUR/USD, GBP/USD and the S&P 500? JPM answers: Here is their view, courtesy of eFXnews: The negative performance of leading risk markets is clearly ruling the market action in different asset classes … “EUR/USD, Cable, SP500: Levels To Targets In Risk-Off –”

A Forex Investment Opportunity with Huge Potential: USD/RUB

America’s relationship with Russia and the former Soviet Union is a strained one, but there’s no reason for currency speculators to hold back when it comes to opportunities in the Russian Federation. The two countries’ position as long-time political adversaries, creates the kind of market conflict that can lead to big gains for sharp Forex … “A Forex Investment Opportunity with Huge Potential: USD/RUB”

Oil Weighs Heavily on Canadian Dollar

Canadian dollar continues to struggle, thanks in large part to falling oil prices and stock prices. The loonie reached a five year low against the greenback earlier, and it appears that the struggle is likely to continue. Oil prices have been losing steam recently, and crude oil is seeing its lowest level in quite some time. Currencies that rely on oil prices, like the Canadian dollar, are hard hit … “Oil Weighs Heavily on Canadian Dollar”

Aussie Losses Steam Following Yesterday’s Rally

The Australian dollar was retreating against its US counterpart today following yesterday’s huge jump. The currency also fell against other major peers even though Australia’s economic data was rather positive. Basically, all data from Australia was good. The Westpac Melbourne Institute Index of Consumer Sentiment rose 0.9 percent in October after falling in September. New motor vehicle sales advanced 2.9 percent … “Aussie Losses Steam Following Yesterday’s Rally”

Dollar Attempts to Recover After Huge Crash

The US dollar ticked up a little today in an attempt to recover from yesterday’s big crash. Unfavorable economic data and the resulting monetary policy outlook remain detrimental to the US currency and may cause another thrust to the downside. The vast majority of yesterday’s economic reports from the United States were rather negative. The biggest surprise for market participants was the huge drop of the New York manufacturing index. Another report revealed that producer … “Dollar Attempts to Recover After Huge Crash”

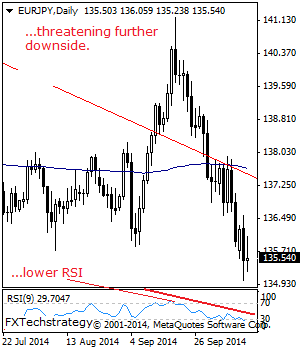

EURJPY: Faces Further Downside Pressure

EURJPY- With the cross turning lower and reversing its Monday gains, further decline is envisaged. Support comes in at the 135.00 level where a break will aim at the 134.50 level. A break will target the 134.00 level with a breach turning focus to the 133.50 level. Below here will aim at the 133.00 level. … “EURJPY: Faces Further Downside Pressure”

Franc Rallies, Rally Unlikely to Persist

The Swiss franc was rising together with the euro against the US dollar today. The Swissie gained on the shared 18-nation currency itself as well. It looks unlikely for the currency to maintain its rally for a long time, though, considering the policy outlook that most market analysts share. While the franc bottomed in the beginning of October and was rising since then, there is strong pressure on the currency to resume decline. The Swiss National Bank … “Franc Rallies, Rally Unlikely to Persist”

Brazilian Real Retains Weakness Ahead of Election

The Brazilian real fell today as concerns about the outcome of the presidential elections deter investors from buying the currency, especially considering that the current geopolitical situation in the world does not encourage to buy riskier assets. Uncertainty about the outcome of the elections was driving the real down previously and continues to hurt the currency now. Currently, polls show that Aecio Neves has more votes than incumbent President Dilma Rousseff. Such … “Brazilian Real Retains Weakness Ahead of Election”

MetaQuotes opens shop in South Africa

After opening shop in the United Arab Emirates, the company behind MetaTrader now launches a new office in South Africa. Here is the official information: Recently MetaQuotes Software introduced MetaFintech as its new representative office in the UAE. The company now announces its further expansion: Derivative System Technologies will act as its agent in South Africa. … “MetaQuotes opens shop in South Africa”