First came factory orders and industrial output. Then came a pessimistic German business confidence survey. And now, the official forecasts of the German government are finally adjusted to the downside, and quite sharply. For this year, the economy ministry expects a growth rate of only 1.2%, a third lower than 1.8% previously forecast. For 2015, the cut is … “Despite significant cuts to forecasts, Germany still seems very”

Month: October 2014

Loonie Gains Against European Counterparts

Better employment data released toward the end of last week is still helping the Canadian dollar in Forex trading today. Indeed, there are hopes that Canadian rates will start rising again. This hope is allowing the loonie to log gains against European currencies, even as it continues to struggle against the greenback. The latest employment data is providing a boost for the Canadian dollar. The latest numbers indicated that … “Loonie Gains Against European Counterparts”

Sterling Continues to Struggle Against Counterparts

UK pound continues to struggle against its major counterparts today, performing mostly lower across the board. Inflation data is a big part of the problem for the sterling today, with concerns about the economy starting to creep back in. Inflation data came in weaker than expected for the United Kingdom. The Office for National Statistics reports that CPI slowed to 1.2 per cent in September, dropping from the 1.5 per cent seen … “Sterling Continues to Struggle Against Counterparts”

EUR/USD: Trading The German ZEW Oct 2014

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Update: German ZEW Economic Sentiment goes negative – EUR/USD approaches support Here are all the details, and 5 possible outcomes … “EUR/USD: Trading The German ZEW Oct 2014”

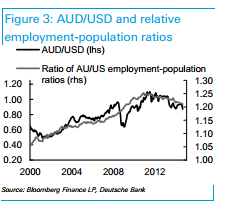

AUD/USD set to decline in 2015 – Deutsche Bank

After AUD/USD dipped below the double bottom, it managed to stabilize and seems to be looking for a new direction. The moves in the shorter term may still be unclear, but the bigger picture is clearer according to Deutsche Bank’s forecasts. Here is their view, courtesy of eFXnews: In a note to clients today, Deutsche Bank … “AUD/USD set to decline in 2015 – Deutsche Bank”

USDCHF: Weakens But With Caution

USDCHF: With the pair closing lower the past week, it faces further downside pressure. However, on the daily chart that weakness seem to have been halted suggesting a resumption of its broader upside could be developing. On the downside, support lies at the 0.9500 level with a break targeting the 0.9450 level and then the … “USDCHF: Weakens But With Caution”

Yen Gains, Downside Threat Remains

The Japanese yen rose today against the US dollar and the Great Britain pound, which were demonstrating softness at the current trading session. But the Japanese currency was unable to outperform the euro, which is now trying to gain ground after it has halted its long decline. The Monday’s trading session was rather quiet as markets in many countries, including Canada, Japan and the United States, were closed for various holidays. … “Yen Gains, Downside Threat Remains”

Dollar Continues to Experience Weakness

The US dollar continued to experience weakness today as comments of US policy makers were less hawkish than dollar bulls have hoped for, suggesting that the long-awaited monetary tightening may be postponed, and this reduced the appeal of the US currency. Minutes of the latest Federal Reserve policy meeting were not as optimistic as was expected, resulting in rather poor performance for the dollar last week. The greenback started this week retaining … “Dollar Continues to Experience Weakness”

EUR/USD: We Went Long Targeting 1.31; Position For A

It seems that the long term direction of euro/dollar is still down, but even if this is true, forex trading is never a one way street. Credit Agricole went long on EUR/USD targeting 1.31, and they explain: Here is their view, courtesy of eFXnews: A stabilisation in ECB/Fed monetary policy expectations should trigger short position squaring … “EUR/USD: We Went Long Targeting 1.31; Position For A”

Euro Receives Respite

Euro is heading higher against many of its major counterparts today, gaining ground as a respite from recent difficulties. Once again, the ECB is promising to do what it takes to keep the eurozone afloat, and that is providing at least some support for the 18-nation currency. Recently, the euro area was pegged as the weakest economic segment in the world economy, and leaders encouraged to do what they can to stimulate growth. In the past, … “Euro Receives Respite”