AUDUSD: Having turned lower off its higher prices following an end to its correction on Thursday, further decline is now seen. Support lies at the 0.8650 level with a cut through here turning attention to the 0.8600 level and then the 0.8550 level where a violation will set the stage for a retarget of the … “AUDUSD: Declines, Targets Further Downside”

Month: October 2014

Economic Data Doesn’t Support Britain’s Pound

Economic news from the United Kingdom were good for the most part today, but it did not prevent the Great Britain pound from dropping and reaching the lowest level in a month against the Japanese yen. Britain’s trade deficit in goods shrank by £1.3 billion to £9.1 billion in August from July, more than was predicted by specialists. The Conference Board Leading Index rose 0.4 percent in August after increasing 0.2 … “Economic Data Doesn’t Support Britain’s Pound”

Dollar Surges on Risk Aversion

Even though the minutes from the latest Fed meeting indicate that some in the FOMC are concerned about what’s next, and how to deal with a stronger dollar during a global economic slowdown, the greenback is heading higher today. Risk aversion is high, and that is reflected in today’s gains by the dollar. Low beta currencies like the US dollar are gaining ground today as risk aversion floods the market. Stocks … “Dollar Surges on Risk Aversion”

Draghi Comments Bring Euro Down

Once again, Mario Draghi is a bit of a downer. His remarks yesterday at the Brookings Institution are dragging on the euro, since they indicate that the ECB is ready to double-down on stimulus measures likely to weigh on the 18-nation currency. Yesterday, ECB President Mario Draghi spoke at the Brookings Institution about what’s next for the euro and the eurozone. He is mentioned that the ECB remains committed to helping to stimulate the flagging eurozone economy, and that … “Draghi Comments Bring Euro Down”

EUR/USD: Waiting For Next Bearish Set-Up; USD/JPY: Buy Dips

The dollar managed to stabilize after the falls but is still far from the highs. What is the next direction for the greenback? ING sees emerging opportunities to buy the dollar against both the euro and the yen. Here is their view, courtesy of eFXnews: EUR/USD’s is back trading around the steep falling trend line around … “EUR/USD: Waiting For Next Bearish Set-Up; USD/JPY: Buy Dips”

Market Movers Episode #19: State of the US job market,

6 years after the crisis broke out, how far has the improvement in the US job market gone? We begin with this big picture overview and continue to a rundown of the FOMC minutes which triggered a huge market reaction. We then discuss the forces bringing oil prices lower and conclude with a quick overview of the … “Market Movers Episode #19: State of the US job market,”

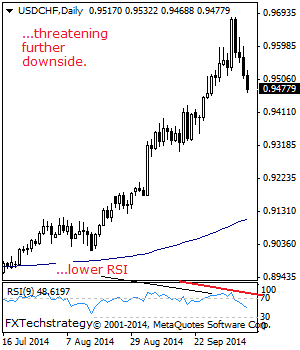

USDCHF: Bearish, Extends Weakness

USDCHF: With the pair remaining vulnerable to the downside and extending its weakness during Thursday trading session, we look for more decline to occur. On the downside, support lies at the 0.9450 level with a break targeting the 0.9400 level and then the 0.9350 level. Further down, support comes in at the 0.9300 level. A … “USDCHF: Bearish, Extends Weakness”

Who will raise interest rates first – the US or UK?

Given the recent performance of GBP/USD the forex markets seem to be veering towards the US raising interest rates first, but there’s still a chance that the Bank of England could pip the US Federal Reserve to the post. If the UK does go first, or is seen to do so, it would suggest that … “Who will raise interest rates first – the US or UK?”

EUR/USD and GBP/USD sell opportunities after the FOMC minutes

The dollar was clearly hit hard by the not-too-hawkish meeting minutes released by the FOMC. Is the dollar expected to continue sliding? RBS says no: Here is their view, courtesy of eFXnews: The retreat in the USD should be viewed as the opportunity to buy, says RBS. “Although admittedly the technical pattern in several currencies … “EUR/USD and GBP/USD sell opportunities after the FOMC minutes”

Pound Higher After BoE Meeting

The Bank of England made no surprise, keeping its monetary policy on hold. Yet the Great Britain pound was still able to trim its losses versus the Japanese yen as well as to keep rallying against the US dollar. The BoE announced today: The Bank of Englandâs Monetary Policy Committee at its meeting on 8 October voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets financed by the issuance … “Pound Higher After BoE Meeting”