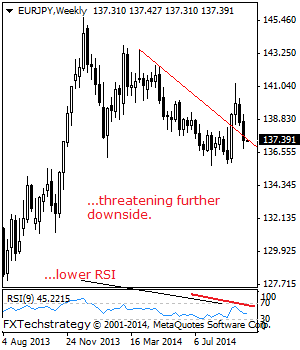

EURJPY- While the cross continues to hold on to its downside pressure, further decline is possible. However, we think a correction higher cannot be ruled out. Support comes in at the 137.00 level where a break will aim at the 136.50 level. A break will target the 137.00 level with a breach turning focus to … “EUR/JPY: Bearish, Vulnerable”

Month: October 2014

Aussie Joins Rally Against Greenback

The Australian dollar joined other most traded currencies in a rally against the US dollar today, while positive economic data from Australia allowed the Aussie to rise against its other major counterparts as well. The greenback halted its rally, allowing other currencies to log gains, and the Australian dollar joined the trend. Domestic macroeconomic indicators added to the bullish momentum of Australia’s currency. The Melbourne Institute Monthly Inflation Gauge rose 0.1 … “Aussie Joins Rally Against Greenback”

USD/CHF Retreats from Highest Since July 2013

The Swiss franc gained on the US dollar today, bouncing from the lowest level since July 2013, as the greenback halted its rally that was fueled by non-farm payrolls released on Friday. The Swissie also managed to log gains against its other major counterparts. The dollar paused its rally, most likely due to profit-taking, and the Swiss currency took its chance to benefit from this. Yet today’s strength of the Swissie does … “USD/CHF Retreats from Highest Since July 2013”

US Dollar Consolidates After Wild End to the Week

The latest payrolls data out of the United States prompted a surge in the greenback, and right now the US dollar appears to be consolidating after its gains. Even though the dollar index is weaker today, there are many that expect more dollar strength to come. The latest NFP data, for September, showed an increase of jobs to the economy, and the unemployment rate dropping to below 6 per cent for the first time in six years. The news … “US Dollar Consolidates After Wild End to the Week”

Pound Struggles a Bit on Economic Data

UK pound is struggling a bit against some of its major counterparts today, thanks largely to recent economic data. While the pound is higher against the dollar right now, it is down against the euro and the yen. Last week ended with a lot of economic data for Forex traders and others to process. One of the bits of data was the fact that September PMI data for the United Kingdom was below expectations. … “Pound Struggles a Bit on Economic Data”

Market Movers Episode #18: Questions for every trader and

Are you really prepared to trade? We ask some questions you should ask yourself as well, before diving into the big events of October, which is a very promising month, especially on the background of September’s turmoil. Welcome to a new episode of Market Movers, presented by Lior Cohen of Trading NRG and Yohay Elam of … “Market Movers Episode #18: Questions for every trader and”

Euro Falls for 12th Week

It was another poor trading week for the euro, which fell for the 12th straight week and reached a new multi-year low against the US dollar. While the European Central Bank policy announcement provided moderate support for the shared 18-nation currency, employment data from the United States did not allow the euro to hold onto gains. The European Central Bank stayed put, preferring not to ease its monetary policy further. … “Euro Falls for 12th Week”

CAD Ends Friday with Losses vs. USD, Gains vs. GBP & JPY

The Canadian dollar ended Friday with losses against its US peer due to overwhelmingly positive employment report from the United States. At the same time, the poor trade balance data from Canada itself did not prevent the currency from rallying against the euro and the Japanese yen. Statistics Canada reported that Canada’s trade balance went from the surplus of C$2.2 billion in July to the deficit of C$610 million in August. Analysts … “CAD Ends Friday with Losses vs. USD, Gains vs. GBP & JPY”

Winter of discontent potentially beckons for EUR

Since May this year the EUR has been ceding ground to the USD, but with winter looming and with the ongoing crisis in the Ukraine the situation could worsen for the single currency. So far the EUR’s losses versus the USD can be explained largely by the actions of the European Central Bank and its … “Winter of discontent potentially beckons for EUR”

UK still not ready for a rate hike

The pound was steady throughout the early part of the week, with investors fairly unresponsive to UK Chancellor George Osborne’s speech at the Conservative party conference. Sterling fell as the week went on, initially in response to dreadful UK current account figures. The deficit printed at £23.1 billion in the second quarter of 2014, up … “UK still not ready for a rate hike”