The Brazilian real gained today on the outlook for monetary policy and hopes that the newly reelected President will form a government able to address financial issues of the country. Investors hope that Dilma Rousseff will create a team capable to initiate reforms that will revitalize the struggling Brazilian economy, and such hopes brought the real up. Previously, the currency fell after Rousseff was reelected as such outcome of the presidential vote was not … “Brazilian Real Bounces on Hopes for Economic Reforms”

Month: October 2014

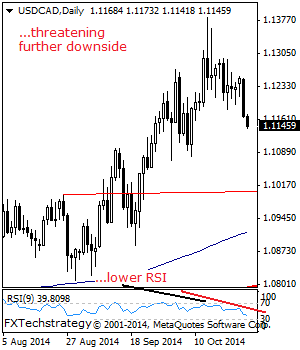

USDCAD: Declines, Eyes Further Downside

USDCAD: With USDCAD declining strongly on Tuesday and following through lower on during Wednesday trading session, further weakness is envisaged. On the downside, support lies at the 1.1100 level followed by the 1.1050 level where a reversal of roles as support is envisaged. Further out, resistance resides at the 1.1000 level and then the 1.0950 … “USDCAD: Declines, Eyes Further Downside”

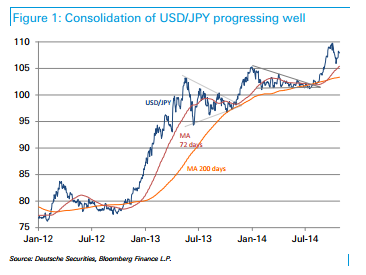

USD/JPY: Stay Bullish For A Retry Over 110 Coming Weeks

Dollar/yen already peeked above 110, but that was the peak for the time and the pair fell to the 105 handle. Since then, we have seen it advance. What’s next? The team at Deutsche Bank has a bullish outlook and sees pair make a move in coming weeks. Here is their explanation: Here is their view, … “USD/JPY: Stay Bullish For A Retry Over 110 Coming Weeks”

UK Pound Struggles Against Its Major Counterparts

UK pound is struggling against its major counterparts today, heading lower as interest rates expectations weigh. With the Bank of England expected to maintain low rates, there isn’t a whole lot to help support the pound against other major currencies in Forex trading. The Forex market is buzzing after yesterday’s comments from Bank of England policymakers. Deputy Governor Jon Cunliffe said that the Bank of England could … “UK Pound Struggles Against Its Major Counterparts”

Euro Trades Down Against US Dollar, Japanese Yen

Euro is gaining ground against the UK pound, but losing ground against the US dollar and the Japanese yen. The 18-nation currency continues to struggle as risk appetite fades from the Forex market, and as expected policy divergence between the United States and the eurozone widens. The latest measure of consumer confidence in the United States underscores the positive direction the US economy is taking. The euro is down against the greenback, in part, on that news. Trade … “Euro Trades Down Against US Dollar, Japanese Yen”

EUR/USD: Is a Dovish FOMC Already Priced In? – BTMU

The US dollar has weakened of late, moving down on disappointing US data, but that isn’t necessarily the only reason. BTMU asks if a dovish FOMC is already priced in, and provides an answer regarding EUR/USD: Here is their view, courtesy of eFXnews: Given how calm the financial markets remain, it is clear that the … “EUR/USD: Is a Dovish FOMC Already Priced In? – BTMU”

5 reasons to dismiss the doubts about the end of QE

Bullard dropped a bomb by suggesting that the Fed should continue QE in October because of worries about global growth, especially those coming from. When a hawk (that gave us a hint on the recent strong NFP) goes dovish, the market certainly listens: stocks jumped and the dollar plunged. While the dollar recovered some ground since then, … “5 reasons to dismiss the doubts about the end of QE”

Weekly Video Analysis

This week’s trading promises to be volatile as key statistics from around the globe hit the market starting with the Business climate index from Germany which is a key indicator of the German economy. Starting Tuesday, we will see key statistics from the US such as durable goods orders, consumer confidence numbers and the eagerly awaited … “Weekly Video Analysis”

The implications of Sweden’s move for USD and GBP

The Riksbank cut Sweden’s interest rates to zero this week citing deflationary pressures and promptly sent SEK plunging. However, the move has implications for US Federal Reserve and Bank of England monetary policy and forex markets generally. The bogeyman of the markets used to be the banks, then it was recession (still an issue to … “The implications of Sweden’s move for USD and GBP”

Forint Gains as Hungarian Central Bank Keeps Rates Stable

The Hungarian forint strengthened yesterday after the nation’s central bank left interest rates unchanged, a move expected by market analysts, and pledged to keep monetary policy stable for as long as it can. The Magyar Nemzeti Bank (the Central Bank of Hungary) decided at yesterday’s meeting to keep its key interest rate at 2.1 percent. The bank has performed a long sequence of rate reductions since 2012 and now is trying to refrain from slashing … “Forint Gains as Hungarian Central Bank Keeps Rates Stable”