The US dollar weakened yesterday and retained its softness today as the string of poor economic data from the United States led to speculations that the Federal Reserve will not start monetary tightening as early as was thought previously. The greenback retained its gains versus the Japanese yen. The dollar was experiencing weakness recently due to poor housing data, and the situation remained the same as the durable goods orders report came out worse … “Dollar Retains Weakness Ahead of FOMC Decision”

Month: October 2014

Ruble Drops on Free-Float Speculations

The Russian ruble dropped today on speculations that Russia’s central bank will abandon defense of the currency and allow it to float freely, and this most likely will lead to even bigger slump in the future. The Russian currency was under pressure from sanctions over the Ukrainian conflict and falling prices for crude oil. The Bank of Russia was trying to keep the exchange rate stable, spending a huge amount of its foreign-currency reserves, but … “Ruble Drops on Free-Float Speculations”

Riksbank Slashes Repo Rate to Zero, Krona Slumps

The Swedish krona dropped today after Sweden’s central bank decided to reduce its main repo rate to the absolute minimum in an effort to spur inflation that was below the bank’s target for a long time. Riksbank cut its benchmark interest rate by 25 basis points to zero at today’s meeting. The bank commented on the decision: The Swedish economy is relatively strong and economic activity is continuing to improve. But inflation is too … “Riksbank Slashes Repo Rate to Zero, Krona Slumps”

Sell Gold On Rallies; Stay Bullish & Long USD –

The US dollar has suffered a couple of blows, from durable goods orders and pending home sales to name a few. However, the team at Bank of America Merrill Lynch is bullish on the greenback and also suggests selling rallies in gold. Here is their view, courtesy of eFXnews: Bank of America Merrill Lynch is … “Sell Gold On Rallies; Stay Bullish & Long USD –”

Loonie Gains a Bit Against Major Counterparts

Canadian dollar is heading a little bit higher today, gaining ground after weakening yesterday. A slight uptick in oil prices, along with better news in European and China, are helping the loonie a little bit. However, there are still challenges ahead for the Canadian dollar. Loonie is getting a reprieve today, after dropping yesterday. The Canadian dollar has been struggling recently, due largely to falling oil prices. … “Loonie Gains a Bit Against Major Counterparts”

GBP/USD: Trading the US CB Consumer Confidence Oct 2014

The Conference Board Consumer Confidence Index is based on a monthly survey of about 5,000 households regarding their opinion of the economic conditions and the overall economic climate. A reading which is higher than expected is bullish for the US dollar. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday … “GBP/USD: Trading the US CB Consumer Confidence Oct 2014”

Japanese Yen Gains Ground Against Major Counterparts

Japanese yen is heading higher against its major counterparts today, getting help from the latest economic data. With an improvement in data, there is the thought that maybe the Japanese government won’t be quite so aggressive at pursuing weakness for the yen. Today, there is a report that the corporate service price index is seeing a gain of 3.5 per cent year over year in Japan. This news … “Japanese Yen Gains Ground Against Major Counterparts”

Euro Gets a Little Help From Stress Test Results

Euro is getting a little help today in Forex trading, thanks to the latest round of stress test results from banks. Things seem to be improving for banks, and that means that there are fewer fears regarding the eurozone. There is still a ways to go for the eurozone recovery, and for the 18-nation currency, but things are looking a little bit better. The latest round of bank stress tests administered by the European Central Bank … “Euro Gets a Little Help From Stress Test Results”

EUR/USD Threatening Trend Resumption

EURUSD: With EUR halting its recovery the past week , it faces downside risk in the new week. On the upside, resistance lies at the 1.2839 level where a break will aim at the 1.2900 level, its psycho level followed by the 1.2950 level. Further out, resistance comes in at the 1.3050 level. Support lies … “EUR/USD Threatening Trend Resumption”

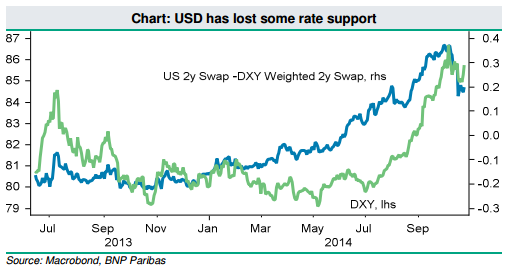

Avoid USD For Now, Focus On EUR Shorts – BNPP

This may not be the perfect time for long positions on the US dollar, says the team at BNP Paribas, even if the medium term outlook is positive. However, this doesn’t mean they are bullish on the euro, not even in the near term. Here is their view, courtesy of eFXnews: “We remain medium-term USD … “Avoid USD For Now, Focus On EUR Shorts – BNPP”