This week was mixed for the US dollar which rose against some major currencies, like the euro and the Japanese yen, but fell against commodity-linked currencies, including the Australian and the Canadian dollar. The week was relatively light on economic data, yet the greenback reacted virtually to every piece of data that came out from the United States. This resulted in very volatile trading as the currency was rising one day and was … “Dollar Ends Week Mixed”

Month: October 2014

Pound Ends Friday with Gains

The Great Britain pound ended Friday with gains thanks to GDP report that was in line with analysts’ expectations and poor economic data from the United States. The currency still ended the week with losses versus the euro. Britain’s gross domestic product grew 0.7 percent in the third quarter of this year from the previous three months. While the expansion was slower than the second quarter’s 0.9 percent, it … “Pound Ends Friday with Gains”

S&P Reaffirms Russia’s Credit Rating, Ruble Higher

The Russian ruble gained today as Standard & Poor’s reaffirmed Russia’s sovereign credit rating, alleviating concerns about a potential reduction of the grade to junk. S&P maintained Russia’s credit grade at BBB-, one notch above the junk rating. The agency cited the following reason for such decision: We expect Russia will maintain a strong net external asset position and moderate net general government debt in 2014–2017. The announcement helped the ruble, … “S&P Reaffirms Russia’s Credit Rating, Ruble Higher”

NZ Dollar Ignores Negative Trade Data

The New Zealand dollar advanced today even though the trade data from New Zealand was rather bad. Yet the kiwi managed to rise as a negative housing report from the United States drove traders away from the US dollar to other currencies. The New Zealand trade deficit expanded from NZ$0.5 billion to NZ$1.4 billion in September, much more than was expected by analysts. It is interesting to note that … “NZ Dollar Ignores Negative Trade Data”

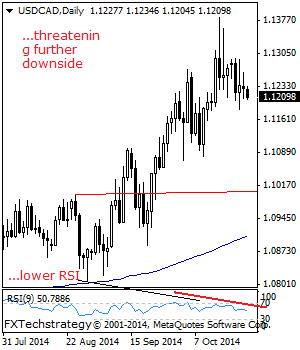

Dollar/CAD: Biased To The Downside On Pullback

USDCAD: Our bias on the pair continues to point lower on correction of its recent strength. On the downside, support lies at the 1.1150 level followed by the 1.1100 level where a reversal of roles as support is envisaged. Further out, resistance resides at the 1.1050 level and then the 1.1000 level. On the upside, … “Dollar/CAD: Biased To The Downside On Pullback”

Major Currencies Positioning & Forecasts – BNP Paribas

Where are currencies headed next? Where will they be in one month and where will currency pairs trade in three months? Stability isn’t on the cards for quite a few pairs. Here is their view, courtesy of eFXnews: The following are BNP Paribas’ latest forecasts (end of period) for major currencies along with its estimates for … “Major Currencies Positioning & Forecasts – BNP Paribas”

German PMIs did NOT forecast Q2 contraction – recession

The euro was cheered by the fact that German manufacturing PMI beat expectations and returned to growth territory: 51.8 points – above 50 that separates growth and contraction. But does this really imply that Germany is out of the woods and can avoid a recession? Not at all. First of all, the data refers to October, which … “German PMIs did NOT forecast Q2 contraction – recession”

Market Movers Episode #21: Bitcoin vs. Gold, Fed decision

Tension is mounting towards the US Fed decision that just became even more interesting. Is stimulus finally set to end in the world’s No. 1 economy? The question of stimulus is also very relevant to the No. 2 economy, China, after the very balanced GDP number. And, we begin with a discussion about bitcoin, by placing it in … “Market Movers Episode #21: Bitcoin vs. Gold, Fed decision”

7-Day Trading Week offered by Panda TS by Adding

Panda TS will now be offering real-time data feed for weekend trading on OTC assets for major FX pairs and gold. This will be available to brokers using the company’s feed or binary options platform. For more details, here is the press release: Tel Aviv, Israel – October 22, 2014 – Panda Trading Technologies (Panda TS) … “7-Day Trading Week offered by Panda TS by Adding”

GBP/USD: Trading the British Preliminary GDP Oct 2014

British Preliminary Gross Domestic Product (GDP) is a key release and is published each quarter. GDP measures production and growth of the economy, and is considered by analysts as one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the pound. Update: UK GDP +0.7% as … “GBP/USD: Trading the British Preliminary GDP Oct 2014”