Pound/dollar fell to new lows, but the pound isn’t that strong against the euro either. The all important quarterly inflation report from the BOE is looming.

What’s next for pound sterling? Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

The latest UK data have been consistent with the theme of an overall cooling in the growth picture from the rapid pace seen at the beginning of the year, notes Morgan Stanley.

“While growth is still robust, the recent moderation appears to have given increased comfort to the BoE to maintain policy for longer. In recent speeches MPC members have been decisively on the dovish side, keeping rate expectations pushed back into the latter part of 2015,” MS adds.

MS also notes that political risks are also on the rise in the UK as the campaigning ahead of next year’s general election gets under way.

“The Labour Party promising a mansion tax on houses over £2 million and the Conservative Party an EU referendum suggest that investment inflows could face headwinds. While FDI flows are currently holding up, with positive M&A inflows to the UK, any signs of these flows slowing will be a long-term negative factor for GBP, in our view,” MS argues.

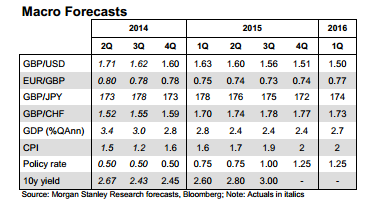

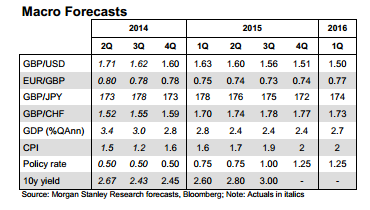

“As a result, we expect GBP to remain under pressure against a stronger USD,” MS concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.