Euro/dollar was hit hard by ECB president Mario Draghi. Can it go further below?

The team at Citi sees one more leg down, explains and sets targets for its short EUR/USD position:

Here is their view, courtesy of eFXnews:

CitiFX Technicals retain its strongly bullish medium term view for the USD suspecting that we could see some more USD strength into the end of this month but that December could see this trade “flattening out”/ correcting before a resumption in January.

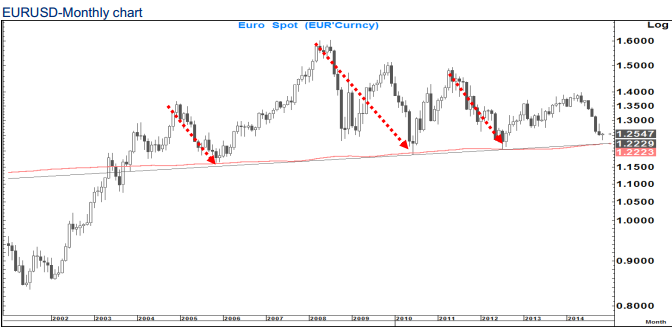

Reflecting that in EUR/USD, Citi continues to hold the view that a move to the 200 month moving average around 1.223 before year end (possibly even next week) is a possibility.

“The 200 month moving average has held all major corrections lower in EURUSD since 2005. While we do expect it to ultimately give way this time, we suspect that will be a 2015 story,” Citi argues.

“For now we think there is the potential for one more low on EURUSD this year close to that average (1.2223) before a pause and resumption of the trade in 2015, as we saw in 1998-1999,” Citi projects.

In line with this view, Citi maintains a short EUR/USD position from 1.2771 targeting 1.22.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.