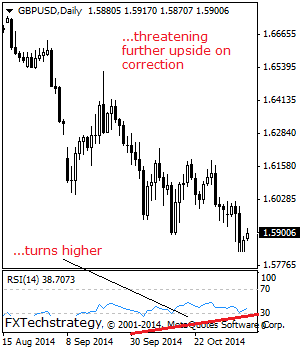

GBPUSD: GBP continues to maintain its broader downside pressure in the medium term but has now triggered a correction higher. On the downside, support lies at the 1.5800 level where a break will aim at the 1.5700 level. A break of here will turn attention to the 1.5650 level. Further down, support lies at the … “GBP maintains broader downside pressure in medium term but”

Month: November 2014

Loonie Gains Some Ground After China Swap Agreement

The Canadian dollar is gaining a little bit of ground today, following an announcement of a currency swap arrangement with China. Also helping the loonie today is the fact that oil prices are moving higher again. Loonie is gaining ground today as the factors that generally help the Canadian currency improve. Oil prices are higher today, thanks in part to positive Chinese economic data. China’s solid performance is … “Loonie Gains Some Ground After China Swap Agreement”

Crypto Currencies Virtual Expo on Dec. 5-6 – Free

A virtual expo about Crypto Currencies will be held on December 5th and 6th, starting at 11:00 EST. The expo brings together bitcoiners and entrepreneurs of the crypto economy. The virtual expo allows anyone to participate, and registration is free. Participants will be able to present, speak and mingle, visit the live booths and engage in … “Crypto Currencies Virtual Expo on Dec. 5-6 – Free”

RBA still downbeat on the Australian dollar

At its latest meeting the reserve bank of Australia decided to keep interest rates on hold at 2,5% seemingly happy with a sustained period of low rates with no hint that the bank will lift them anytime soon. In his latest monetary speech last week, RBA governor Glen Sevens noted, “Volatility in some financial markets … “RBA still downbeat on the Australian dollar”

GOLD: Threatens Recovery

GOLD: With GOLD halting its weakness the past week to close slightly higher on a rejection candle, it faces recovery higher. On the downside, support stands at the 1,131.57 level. Below here if seen could trigger further downside towards the 1,100.00 level where a break will aim at the 1,080.00 level. Its daily RSI is … “GOLD: Threatens Recovery”

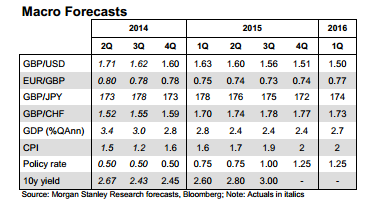

GBP: Data Cooling, Dovish BoE; Outlook & Forecast –

Pound/dollar fell to new lows, but the pound isn’t that strong against the euro either. The all important quarterly inflation report from the BOE is looming. What’s next for pound sterling? Here is the view from Morgan Stanley: Here is their view, courtesy of eFXnews: The latest UK data have been consistent with the theme of … “GBP: Data Cooling, Dovish BoE; Outlook & Forecast –”

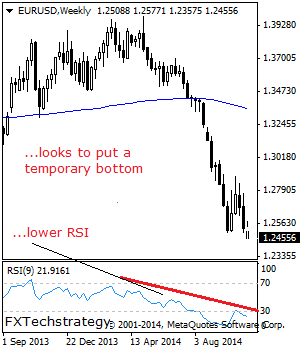

EURUSD: Recovery Risk Develops

EURUSD: With the pair closing marginally lower following its strong Friday close (see daily chart), it faces the risk of a recovery higher in the new week. If this occurs, expect more strength to occur towards the 1.2577 level. Further out, resistance resides at the 1.2700 level where a breach will aim at the 1.2770 … “EURUSD: Recovery Risk Develops”

Third Weekly Drop for EUR/USD

The euro demonstrated a third weekly decline in a row against the US dollar this week. Yet the currency’s performance was not as bad as one might have expected considering fundamentals. The shared 18-nation currency managed to gain on the Great Britain pound and the Japanese yen over the week. The major negative event for the euro was the policy announcement from the European Central Bank. While the ECB did not change its monetary policy, comments … “Third Weekly Drop for EUR/USD”

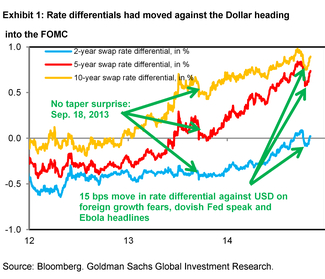

3 Factors Call For More Conviction In Our Strong Dollar

The dollar had a strong week but the mixed Non-Farm Payrolls report certainly allowed for some profit taking. What’s next for the greenback? The team at Goldman Sachs provide 3 factor that call for more conviction in the strength of the greenback. Here is their view, courtesy of eFXnews: “It is three weeks ago today that … “3 Factors Call For More Conviction In Our Strong Dollar”

Market Movers Episode #23: ECB rundown, the yen sell-off

Markets are moving fast and there’s a lot talk about: the high expectations for the Non-Farm Payrolls, a dive into Draghi’s determined drive, an explanation about the plunge of the yen, a look forward into big events in the UK and a look at Brazil. Welcome to a new episode of Market Movers, presented by Lior Cohen … “Market Movers Episode #23: ECB rundown, the yen sell-off”