The Canadian dollar got a boost from extremely positive domestic employment report, which was released today. The loonie rose against the majority of its most-trading peers, reaching the highest level since 2008 versus the Japanese yen. Like non-farm payrolls, Canada’s employment report surprised the Forex market. But unlike the US data, Canada’s employment made a positive surprise. Analysts predicted a drop by 3,900 for October, but in reality employment … “CAD/JPY Touches Record High Since 2008 on Employment”

Month: November 2014

Euro Gains vs. Dollar on Back of Disappointing US Employment

The euro gained on the US dollar today after employment data from the United States missed analysts’ projections. The currency also rallied versus the Great Britain pound but was unable to advance against the Japanese yen. US non-farm payrolls grew by 214,000 jobs in October. While not bad by itself, the figure was below market expectations. Yet at the same time the unemployment rate dropped to 5.8 percent, even though experts … “Euro Gains vs. Dollar on Back of Disappointing US Employment”

When push comes to shove, Germany will blink on QE

QE is verboten, no? Guest post by Jamie Coleman Yes, but so were EU bailouts for the likes of Greece, Ireland, Portugal and Spain earlier this decade. Such measures were unthinkable right up until the time that Germany realized there was no alternative and caved to the reality that without bailouts the euro area would collapse. … “When push comes to shove, Germany will blink on QE”

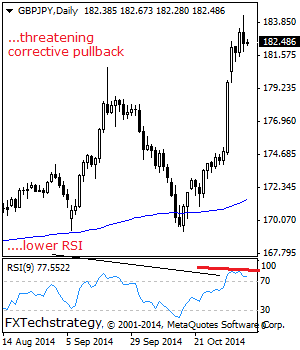

GBP/JPY Faces Pullback Risk

GBPJPY – Watch out for further strength as more gains are envisaged. cross is now seen hesitating suggesting a corrective pullback. On the upside, resistance lies at the 183.50 level followed by the 184.50 level where a break will aim at the 185.50 level. A cut through here will aim at the 186.50 level. Its … “GBP/JPY Faces Pullback Risk”

No Help for the UK Pound in Forex Trading

There isn’t a lot of help for the UK pound in forex trading today. With recent data disappointing analysts, and with the Bank of England still not taking any action, the sterling is down almost across the board today. Sterling is losing ground to most of its major counterparts today as concerns about what’s next for the currency weigh. First of all, the drop in PMI to 56.2 from 58.7 was a bit of a setback. For the most … “No Help for the UK Pound in Forex Trading”

US Dollar Moderates a Bit

Greenback is consolidating ahead of today’s US nonfarm payrolls data for October. Dollar index is a little bit lower right now, and the euro has made a few gains following its steep losses yesterday. US dollar is evening out a bit after a spectacular rally that came yesterday on the heels of Mario Draghi’s comments about what the ECB might have to do in order to stimulate the eurozone economy. Draghi … “US Dollar Moderates a Bit”

Worst Week for Ruble Since 1999

Woes for the Russian ruble continue as the currency experienced the worst week since 1999. Analysts think that the ruble may go even lower, reaching the 50 per dollar level. Reasons for currency’s weakness remain the same: the situation in Ukraine and falling oil prices. The decline of prices for crude was hurting currencies of oil-exporting economies, while the escalating conflict in Ukraine may result in a new round of sanction against Russia. Most economists believe … “Worst Week for Ruble Since 1999”

Ringgit Heads to Biggest Weekly Decline Since 2013

The Malaysian ringgit dipped today as falling crude oil prices threatened the nation’s economy. Strength of the US dollar also had a negative impact on the currency’s performance. The ringgit headed to the biggest weekly decline since September 2013. Futures for crude oil dropped in New York, reaching the lowest level since 2011. This is bad news for ringgit as crude accounts for about 30 percent of Malaysia’s export revenue. The Bank Negara Malaysia … “Ringgit Heads to Biggest Weekly Decline Since 2013”

EUR/USD: Trading the US NFP Nov 2014

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Update: NFP +214K, good internal data Here are the details and 5 possible outcomes for EUR/USD. Published on … “EUR/USD: Trading the US NFP Nov 2014”

Australian Dollar Stable After RBA Minutes & Construction Data

The Australian dollar held steady during the current trading session after the release of the central bank’s policy minutes and the report about the construction sector. Yesterday, the currency fell against the US dollar, rose against the euro and was flat against the Japanese yen. The Reserve Bank of Australia released minutes of its latest policy meeting, and the statement had dovish bias. The central bank estimated in its outlook that economic growth and inflation will … “Australian Dollar Stable After RBA Minutes & Construction Data”