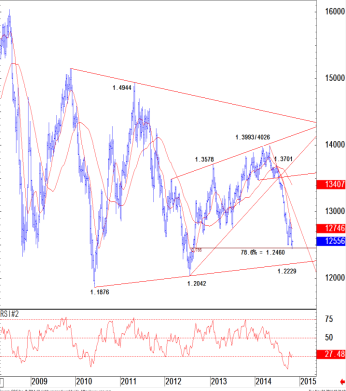

Banks remain bearish on EUR/USD and the arguments are both technical and fundamental. The notable exception is Credit Agricole. The Team at Credit Suisse join the bearish bandwagon, and use Fibos to explain the next low target for EUR/USD: Here is their view, courtesy of eFXnews: EUR/USD keeps holding above key support at 1.2460 – the 78.6% … “EUR/USD: Holding 78.6% Fibo But Stay Bearish & Short –”

Month: November 2014

US Dollar Surges Following US Midterm Elections

US dollar is surging right now, heading higher against its major counterparts, following the US midterm elections. Comparisons between the United States and its European counterparts are mostly about differences in economic directions, and many feel that the latest election results will mean fewer legislative restrictions for business, and that will boost the US economy. Greenback has already been showing strength, and now the currency is … “US Dollar Surges Following US Midterm Elections”

Market Movers Episode #22: Preview of November’s big events,

There is a lot of action in markets and more to come: we preview the big events of November, which promise to be exciting. And before looking forward, we look back and run through the Fed bullishness, the impact of US GDP, ECB stress tests and more. Welcome to a new episode of Market Movers, presented by … “Market Movers Episode #22: Preview of November’s big events,”

Yen Drops After Kuroda’s Speech

The Japanese yen fell against almost all major currencies as comments of the central bank’s chief resulted in speculations that monetary easing will remain in place for a long time and additional monetary stimulus is possible. Bank of Japan Governor Haruhiko Kuroda was speaking in Tokyo today. He said in the speech that the central bank will keep quantitative and qualitative easing “as long as necessary” for reaching the 2 percent inflation target. Moreover, … “Yen Drops After Kuroda’s Speech”

NZD Rises After Employment Data, Loses Steam on Services Index

The New Zealand dollar climbed today with the help of very positive employment data that made New Zealand assets more attractive to investors. The currency lost its upward momentum (though stayed above the opening level) after a report that showed decline of the services sector. New Zealand employment grew 0.8 percent in the third quarter of 0.8, above the analysts’ projections of 0.6 percent. The unemployment rate fell by 0.2 percentage … “NZD Rises After Employment Data, Loses Steam on Services Index”

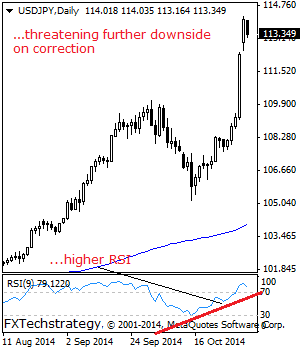

USD/JPY: Faces Pullback Risk

USDJPY: Although extending its strength on Monday, pullback threats cannot be ruled out. On the upside, resistance resides at the 114.50 level followed by the 115.00 level where a break will target the 115.50 level. Further out, resistance comes in at the 116.00 level where a violation will aim at the 116.50 level. On the … “USD/JPY: Faces Pullback Risk”

Euro Pares Gains as European Union Revises Outlook

Euro is mostly higher today, but the 18-nation currency is paring some of its gains. The latest growth outlook from the European Union has been revised lower, and that is weighing a bit on the euro, and causing it to give up some of its earlier gains. Earlier, the euro saw some solid gains against its major counterparts as the US dollar pulled back and as the outlook for the world in general improved a bit. … “Euro Pares Gains as European Union Revises Outlook”

US Dollar Falls Back, Consolidating Against Major Currencies

US dollar is a little big lower today, falling back after rallying earlier. Right now, the greenback is consolidating, and Forex traders are taking profits. However, there is a good chance that the US dollar will remain relatively strong overall. After its last policy meeting, Federal Reserve officials indicated that they may raise interest rates sooner than expected if the job … “US Dollar Falls Back, Consolidating Against Major Currencies”

Won Drops vs. Dollar, Domestic Fundamentals Remain Supportive

The South Korean won dipped today against the dollar as the US currency was propelled higher by positive economic data from the United States. Reports from South Korea itself were not bad either and may yet provide support for the won. The greenback rallied after the manufacturing index from Institute for Supply Management climbed to the highest level since March 2011. As for data from South Korea, the trade balance surplus rose … “Won Drops vs. Dollar, Domestic Fundamentals Remain Supportive”

NZ Dollar Finds Strength in Spite of Economic Data

The New Zealand edged higher against its US peer and erased earlier losses versus the Japanese yen today even though economic data from New Zealand was not particularly good for the currency. The ANZ Commodity Price Index declined 0.8 percent in October, demonstrating the eighth consecutive monthly drop. The report commented on the NZ dollar’s performance last month: The value of the New Zealand dollar fell 2.1% on a TWI basis … “NZ Dollar Finds Strength in Spite of Economic Data”