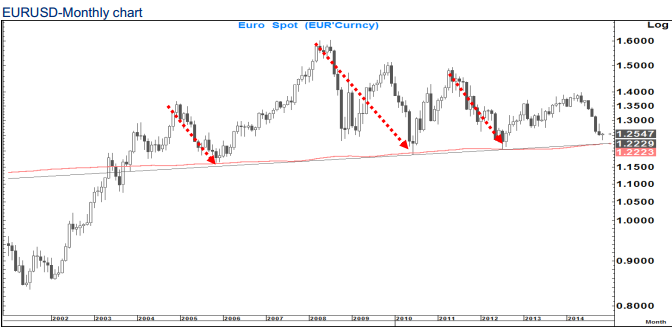

EUR/USD had its lowest weekly close since 2012 at the end of last week, below 1.24. Can we expect a correction now or is another leg down on the world’s most popular pair? The team at Barclays suggests staying short and provide some nice charts: Here is their view, courtesy of eFXnews: Investors following tactical strategies should … “Stay Short EUR/USD & Sell Bounces – Barclays’ Trade Of”

Month: November 2014

Deal with China predicted to boost the Australian economy

The Australian economy received a significant boost last week after the announcement that Australia and China would sign a free trade agreement pumping an additional $18 billion into the local economy over the next decade, and potentially offsetting the effects of the mining boom that many say is coming to an end. Australia is Chinas … “Deal with China predicted to boost the Australian economy”

EUR/USD: Trading the US Preliminary GDP Nov 2014

US Preliminary Gross Domestic Product (GDP) is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. Thus, an unexpected reading for US GDP could affect the movement of EUR/USD. A reading which is better than the market forecast is bullish for the dollar. … “EUR/USD: Trading the US Preliminary GDP Nov 2014”

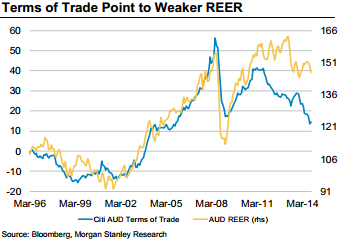

Staying Short AUD/USD: Bearish We Stand; – Morgan Stanley

The Australian dollar managed to pare some of its losses thanks to the news about the Chinese rate cut late in the week. But is this enough for a move to the upside? The team at Morgan Stanley remain bearish on AUD/USD and set targets: Here is their view, courtesy of eFXnews: Relative to consensus, Morgan … “Staying Short AUD/USD: Bearish We Stand; – Morgan Stanley”

Euro Loses Ground by Weekend

Initially, it looked like this trading week would be another week of consolidation for the euro. Yet the shared 18-nation currency lost its ground by the weekend due to combined influence of poor economic indicators and comments from European policy makers. Comments of European officials hurt the euro at the start of the week. The positive German economic sentiment allowed the currency to gain ground, but this did not last long as the positive data … “Euro Loses Ground by Weekend”

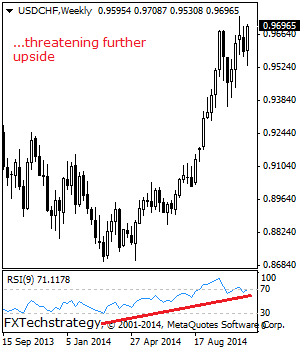

USDCHF: Reverses Losses, Eyes The 0.9741 Level

USDCHF: With the pair reversing its previous week losses and closing higher on Friday, it faces price extension in the new week. On the upside, resistance resides at the 0.9741 level, its year-to-date high where a break will aim at the 0.9800 level. Further out, resistance resides at the 0.9850 level. A breather may occur … “USDCHF: Reverses Losses, Eyes The 0.9741 Level”

China’s Interest Rate Cut Lifts Australian Dollar

The Australian dollar climbed today, reaching the highest level in more than a year and half against the Japanese yen. The rally followed a surprise interest rate cut from China’s central bank. The Peopleâs Bank of China made an unexpected move today, announcing that it lowers the one-year deposit rate by 0.25 percentage point to 2.75 percent and reduces the one-year lending rate by 0.4 percentage point to 5.6 percent. The changes will take … “China’s Interest Rate Cut Lifts Australian Dollar”

Canadian Inflation Pushes Loonie to New Highs

The Canadian dollar rose today, touching the highest level in a month against its US counterpart, as Canada’s inflation exceeded expectations. The currency also rallied to the strongest level in a year versus the euro and reached a new multi-year high against the Japanese yen. The Canadian Consumer Price Index rose 0.1 percent in October from September on a seasonally adjusted basis while economists expected a drop. The core CPI was up 0.2 percent (seasonally … “Canadian Inflation Pushes Loonie to New Highs”

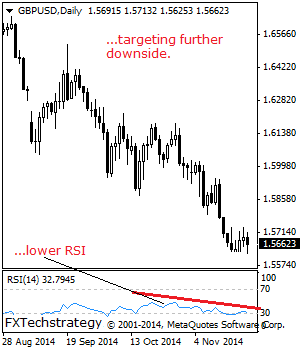

GBPUSD: Broader Bias Remains Lower

GBPUSD: We continue to hold on to our downside bias on GBP despite its recovery attempts. On the downside, support lies at the 1.5600 level where a break will aim at the 1.5550 level. A break of here will turn attention to the 1.5500 level. Further down, support lies at the 1.5450 level. Resistance resides … “GBPUSD: Broader Bias Remains Lower”

EUR/USD: One More Leg Lower Before Flattening-Out In Dec

Euro/dollar was hit hard by ECB president Mario Draghi. Can it go further below? The team at Citi sees one more leg down, explains and sets targets for its short EUR/USD position: Here is their view, courtesy of eFXnews: CitiFX Technicals retain its strongly bullish medium term view for the USD suspecting that we could see … “EUR/USD: One More Leg Lower Before Flattening-Out In Dec”