The Swiss franc sank today as Governing Board Member Fritz Zurbruegg said that the Swiss National Bank will take any steps required to keep the ceiling on the currency in place. The Swissie declined together with euro. Zurbruegg said in a speech yesterday: The SNB will continue to enforce the minimum exchange rate with the utmost determination. To this end, it is prepared to purchase foreign exchange in unlimited quantities and to take further measures … “Swiss Franc Joins Euro in Decline”

Month: November 2014

Euro Plunges Following Draghi’s Comments

Euro is heading much lower today, plunging following the latest comments by ECB President Mario Draghi. His insistence that the ECB will do whatever it takes to stimulate the eurozone economy is driving the 18-nation currency lower today. Euro continues to trade near session lows today, losing ground across the board following the latest remarks from Mario Draghi, the President of the European Central Bank. Draghi indicated … “Euro Plunges Following Draghi’s Comments”

Yen Rebounds on Finance Minister’s Comments

The Japanese yen rallied today after Japan’s Finance Minister Taro Aso commented on the recent slump of the currency, saying it was too quick. Aso said today that “the pace of the decline in the past week has been too fast.” It is rare that Japanese officials complain about weakness of the yen, though economists believe that Aso had problem with the pace of the movement, not its direction. Signs … “Yen Rebounds on Finance Minister’s Comments”

USD/JPY: Short-Term Positioning Circuit Breaker – Credit Agricole

Japanese politicians are becoming some somewhat anxious with the rapid fall of USD/JPY. Can this mark a turnaround in the fate of the currency? Or perhaps a necessary correction? The team at Credit Agricole weighs in: Here is their view, courtesy of eFXnews: In our latest FX Monthly Cease-fire broken we revised our JPY forecasts lower … “USD/JPY: Short-Term Positioning Circuit Breaker – Credit Agricole”

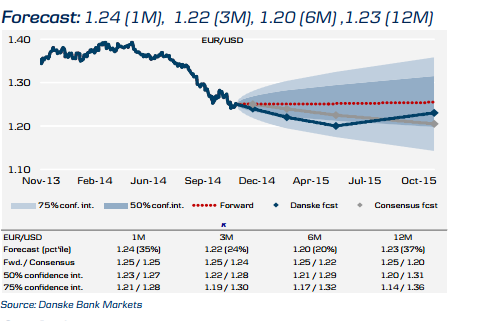

EUR/USD: Consolidating Before Next Leg Lower; Outlook & Forecast

EUR/USD is stuck in a well defined range. While this is a nice setup for some trades, many others would prefer to see a break out. To what direction? The team at Danske sees a consolidation before the next leg lower and they explain: Here is their view, courtesy of eFXnews: We expect EUR/USD to … “EUR/USD: Consolidating Before Next Leg Lower; Outlook & Forecast”

Pound Trades Mixed to Lower Following Rally

The Great Britain pound was little changed at the start of the current trading session, edging a little lower against the euro and the Japanese yen. The currency rallied yesterday due to better-than-expected retail sales. UK retail sales rose 0.8 percent in October after falling 0.4 percent in September. Analysts predicted smaller growth by 0.4 percent. The positive data allowed the currency to rise, touching the highest level since October 2008 against the yen. … “Pound Trades Mixed to Lower Following Rally”

US Dollar Mixed, Touches New Multi-Year High vs. Yen

The US dollar was mixed today despite fairly supportive economic reports from the United States. Still, the currency managed to reach new multi-year high versus the Japanese yen before pulling back closer to the opening level. With inflation above analysts’ projections and unexpectedly good manufacturing data from the Philadelphia Fed, one might assume that the dollar would outperform its peers. Yet it was not so. … “US Dollar Mixed, Touches New Multi-Year High vs. Yen”

Swiss gold vote has potential to unsettle forex markets

A public referendum to be held on November 30 in Switzerland over whether the Swiss National Bank should have 20% of its holdings in gold could create volatility for CHF and of course gold. If the Swiss vote for the SNB to hold more gold that would send gold prices higher, whilst pushing CHF lower … “Swiss gold vote has potential to unsettle forex markets”

Aussie Shows Resilience in Face of Bad Data

The Australian dollar fell earlier today as economic data from around the world suggested that global growth is losing steam. Yet the currency demonstrated resilience and bounced back to the opening level as of now. Economic news from China and Europe was rather negative, leading to decline of growth-related currencies, including the Aussie. Yet the Australian currency managed to regain its footing in face of negative fundamentals. Australia’s dollar was consolidating lately, … “Aussie Shows Resilience in Face of Bad Data”

What’s Next For USD Bull Market, EUR/USD, & USD/JPY? –

EUR/USD paused its fall and is looking for a direction while USD/JPY is going vertical. These major pairs may have a longer way to go in favor of the dollar. The team at Goldman Sachs looks at the bigger picture: Here is their view, courtesy of eFXnews: “USD strength has been a feature of our … “What’s Next For USD Bull Market, EUR/USD, & USD/JPY? –”