This week was rather good for the euro. The shared 18-nation currency managed to stall its decline versus the US dollar and even rallied against the Great Britain pound and the Japanese yen. It is still questionable, though, whether the currency will be able to retain its strength in the future. The euro traded mixed for the most part of the week, rising against the dollar on Thursday due to worse-than-expected economic data from the United States. … “EUR/USD Consolidates, EUR/GBP & EUR/JPY Rally Over Week”

Month: November 2014

EUR/USD: University of Michigan Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer confidence beats expectations at 89.4 points Here are all the details, and 5 possible outcomes … “EUR/USD: University of Michigan Consumer Sentiment Index”

Woes of Brazilian Real Continue

The Brazilian real continues to experience weakness. Today’s drop is a result of worse-than-expected macroeconomic data. Concerns about the government’s ability to tackle fiscal challenges, which the country is enduring, also played their role Brazil’s retail sales rose 0.5 percent in September from the same month a year ago, missing the median forecast of 0.7 percent. President Dilma Rousseff is going to appoint a new finance minister, and market participants … “Woes of Brazilian Real Continue”

Traders See No Reasons to Buy Yen

The Japanese yen weakened today, trading near the lowest level for this year against the euro and reaching the weakest rate in more than seven years versus the US dollar. Traders have plenty of reasons to sell the yen and few to buy the currency. Prime Minister Shinzo Abe will speak at a press-conference next week, talking about the delay of the next sales tax hike. He may announce dissolution of the parliament. Meanwhile, Japanese stocks … “Traders See No Reasons to Buy Yen”

Sterling Set to Close Much Lower on the Week

UK pound continues to struggle in currency trading, and this week looks to end on a low note. Even with signs that the economy could be improving, the sterling is still down against its major counterparts. One of the biggest stumbling blocks for the pound is the fact that it doesn’t look as though inflation is going to be an issue for the UK economy, and the Bank of England isn’t ready to raise rates anytime soon. … “Sterling Set to Close Much Lower on the Week”

US Dollar Surges Higher Overnight

US dollar is heading higher, gaining ground in overnight trading and recovering after recent losses. The greenback is showing strength as other currencies, notably the pound and the yen, show weakness. There is not a lot to stop the US dollar right now, with uncertainties about geopolitical outcomes, and the fact that the US economy remains on the road to recovery, even as other economies fall behind. Greenback is higher almost across … “US Dollar Surges Higher Overnight”

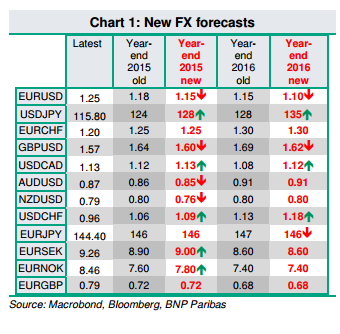

USD Is King; New FX Forecasts – BNPP

What are the prospects for currencies looking forward to the new year? The team at BNP Paribas provides bold forecasts for the dollar, especially against the euro and the Japanese yen. Commodity currencies may enjoy a better fate. Here goes: Here is their view, courtesy of eFXnews: BNP Paribas revised today its FX forecasts to … “USD Is King; New FX Forecasts – BNPP”

Market Movers Episode #24: Diving into Australia, US jobs

The Aussie is a very popular currency and for good technical and fundamental reasons. After diving down under, we go back to the USA and examine all jobs numbers leading to the FOMC minutes. The British pound has been punished, but is it justified? And finally, we don’t miss the falling Japanese yen ahead of … “Market Movers Episode #24: Diving into Australia, US jobs”

German GDP Analysis: Good news for Germany, bad news for

Germany avoided a technical recession and managed to claw some growth. It also enjoyed upwards revisions and a better y/y growth rate. So, Germany managed to print some growth despite tensions with Russia and a general gloom. So, is Germany back to the driver seat, and can pull the euro-zone forward as the locomotive of growth? Not exactly. A … “German GDP Analysis: Good news for Germany, bad news for”

USD/JPY: The Next Set Of Levels – Citi

Dollar/yen continues higher and is sitting above 116. What’s next for the fast moving pair? And what factors could move it? The team at Citi discusses the elections and very high levels for USD/JPY: Here is their view, courtesy of eFXnews: The previous setup and consolidation in the first half of this year looks similar to … “USD/JPY: The Next Set Of Levels – Citi”