Greece is back to the headlines after PM Samaras’ presidential bid failed and the country is heading to parliamentary elections. This has already weighed on the euro, but is there more? The team at Nomura provides 4 reasons why the euro’s downfall could accelerate in early January: Here is their view, courtesy of eFXnews: With … “4 reasons why EUR downside could accelerate because of”

Month: December 2014

Consumer Confidence Not Enough for the US Dollar

US dollar is losing ground today against its major counterparts, even though there is a degree of risk aversion in the markets, and consumer confidence is on the rise. The news that Russia and China continue to work to bypass the greenback is one item adding to dollar weakness. The latest US consumer confidence index survey showed a rise to 92.6 this month, from a revised 91.0 in November. This data is still … “Consumer Confidence Not Enough for the US Dollar”

Yen Gains as Traders Seek Safe Investment Options

The Japanese yen rallied today, rising against all of its major peers, as the risk-negative market sentiment spurred traders to seek safer assets. The currency demonstrated the biggest gain in two weeks versus the US dollar. The market sentiment has already been averse to risk due to the drop of oil prices. Yet the situation in Europe (and Greece in particular) increased demand for safer investment options even further. As a result, the yen rallied, undoubtedly making … “Yen Gains as Traders Seek Safe Investment Options”

Pound Gains vs. Dollar, Retreats vs. Yen

The Great Britain pound gained today against the US dollar on the back of relatively positive housing data. Gains were limited though, and the currency dropped versus the Japanese yen. The Nationwide House Price Index rose 0.2 percent in December. While it was not a bad result, the increase was smaller than the November’s 0.3 percent. HPI growth slowed on an annual basis as well. Despite the small gain of the pound on the dollar, analysts … “Pound Gains vs. Dollar, Retreats vs. Yen”

Trading the EUR/CHF peg at 1.2000

If someone says he has a 100% trade setup in the Forex Market, you have to be very skeptical about the person. Do not forget something: there is no 100% trade setup in this business. You have to be always prepared for the unexpected. You need different strategy for different pairs as many pairs have … “Trading the EUR/CHF peg at 1.2000”

Israel’s Central Bank Maintains Key Interest Rate, Shekel Down vs. Dollar

The Israeli new shekel fell against the US dollar today even though the nation’s central banks decided to keep its main interest rate unchanged at yesterday’s monetary policy meeting as the outlook for Israel’s economy was relatively positive. The currency gained on the euro. The Bank of Israel decided to keep its benchmark interest rate at 0.25 percent. It looks like the previous interest rate cuts had an effect and the nation’s economy is … “Israel’s Central Bank Maintains Key Interest Rate, Shekel Down vs. Dollar”

Dollar Gains on Euro for Third Session

The US dollar rallied yesterday and continued to gain on the euro today, reaching a new multi-year high. The greenback also was strong against the Great Britain pound but slipped versus the Japanese yen. The US currency gained on the currency of the eurozone for the third straight session due to concerns about the outcome of the Greek elections. Experts are concerned that in case of victory of the opposition Syriza party the bailout package or even the place of the Greece in the eurozone will … “Dollar Gains on Euro for Third Session”

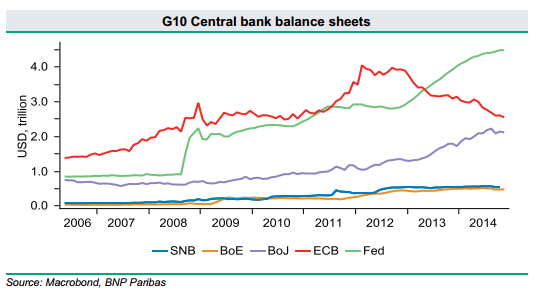

EUR/USD To Start Its Descent To 1.15; We Stay Short

After all the falls in EUR/USD, is there still time for a short? All those 2015 predictions are getting closer as 2014 draws to an end. The team at BNPP sees the descent to 1.15 starting soon, explains and provides a chart: Here is their view, courtesy of eFXnews: Policymakers will continue to dominate the … “EUR/USD To Start Its Descent To 1.15; We Stay Short”

Stocks, Greek Elections Don’t Bring Euro Down

Euro is a little bit rattled today, but not enough to be seeing losses to its major counterparts yet. Between lower stocks across the eurozone, and concerns about the outcome of Greek elections, many expected the 18-nation currency to be doing worse today. Euro isn’t doing as poorly as some expected earlier. Instead, the euro is up against many of its major counterparts, logging gains even though things … “Stocks, Greek Elections Don’t Bring Euro Down”

Swiss Franc Declines as Consumption Indicator Ticks Down

The Swiss franc declined against the euro today as consumption indicators fell slightly last month. The report was not completely negative though as it said that the Christmas season had a good start for the retail sector. At the same time, the currency gained versus the dollar. The UBS consumption indicator fell a bit from 1.32 to 1.29 points in November. The report said: Fewer new car registrations are weighing on consumption, but on the positive … “Swiss Franc Declines as Consumption Indicator Ticks Down”