EUR/USD managed to recover from the lows despite the poor TLTRO and the diverging paths of monetary policies.

The team at Goldman Sachs explains why there is a large downside to the pair with sovereign QE looming:

Here is their view, courtesy of eFXnews:

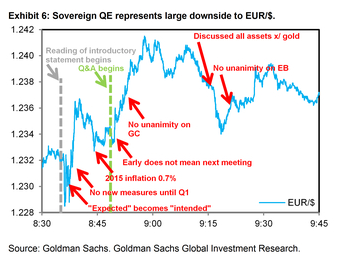

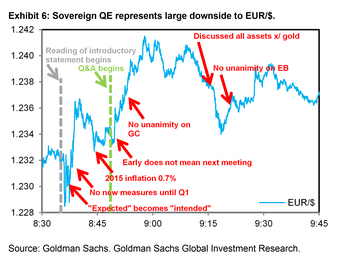

“We study tic-by-tic moves in the Euro during last week’s ECB press conference, which saw EUR/$ spike higher. We think the price action underscores our take that the single currency is not pricing sovereign QE, validating our view of significant downside in EUR/$ in the months ahead.

We think this price action is revealing in a couple ways: (i) the initial move lower in EUR/$ on “expectation” becoming “intended” underscores once again – as did the November press conference – that the ECB’s goal of expanding the balance sheet by €1trn is not yet fully priced, leaving aside the question of whether (and when) sovereign QE is coming; and (ii) the market is still distrustful that the ECB may do sovereign QE in short order given the divisions on the Governing Council. We see both things as meaningful, given our conviction that sovereign QE is coming – indeed, as we note above, President Draghi’s use of the term QE was the most ever during last week’s press conference.

Overall, we see this price action as reinforcing our view that sovereign QE means substantial downside for EUR/$ and that the market remains behind the curve in anticipating this event.”

Robin Brooks, Fiona Lake and Michael Cahill – Goldman Sachs

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.