EUR/USD has made a nice recovery from the lows. Is it all over for a new fall in the world’s most popular pair?

The team at Goldman Sachs examines the wedge:

Here is their view, courtesy of eFXnews:

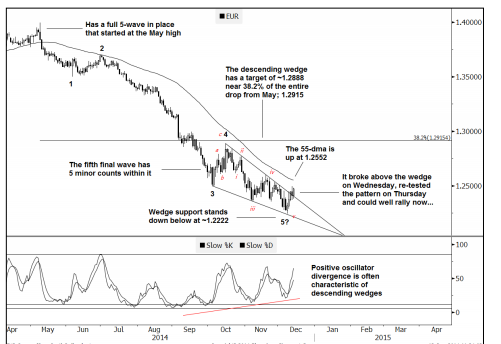

EUR/USD closed above the top of the pattern last Wednesday, re-tested the break point on last Thursday and has since turned back higher again, notes Goldman Sachs.

“All in all, it seems EURUSD is gradually making its way higher from a textbook ending wedge. An ending wedge/falling diagonal occurs primarily in the fifth wave of a 5-wave sequence which fits this chart’s count quite nicely,” GS clarifies.

“It completes on a break through the top of the pattern and frequently precedes a sharp move higher. In this case, the wedge targets a move back to the Oct. 15th high (the top of wave 4) at 1.2888 near 38.2% retrace from the May ’14 high (1.2915),” GS projects.

Further confidence in this view, according to GS, will be given by a daily close above the 55-dma at 1.2552 where the market hasn’t seen a close above this pivot since the actual May 8 th high.

This technical set-up, according to GS, suggests that EUR/USD low may already be in for the year.

“It is worth highlighting that the market has based at 1.2248 right above a trendline extended across the lows since Jun. ‘10 at 1.2230. Overall, the balance of signals seem to be suggesting that the drop from May ‘14 is now a complete 5-wave sequence. It may now be in the initial stages of a (ABC-type) corrective process,” GS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.