In two major pairs, the team at Nomura finds very interesting patterns. These are a wave 3 correction in EUR/USD and a Head & Shoulders top in USD/JPY.

Here are the charts and the explanations:

Here is their view, courtesy of eFXnews:

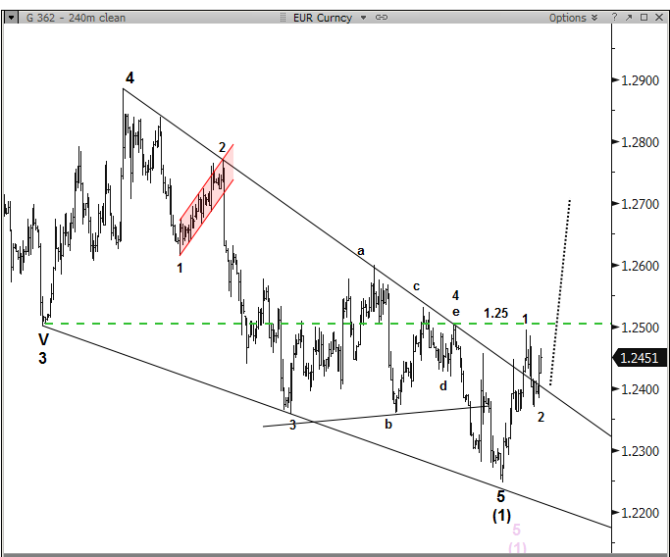

In EUR/USD, Nomura still holds the view that the falling wedge from October fits well as a wave-5 and that means Euro is starting a corrective countertrend rally.

A confirmation of this view, according to Nomura, came in the break of wedge resistance and the weekly close above 1.2425 will confirm.

“Above 1.25 will raise conviction as this clears key pivot resistance as well,” Nomura adds.

“S/t, Wave-(1) up is done as is a proper wave-(2) correction to the 50% Fib. Look for a break of 1.2500 to suggest that this new recovery is wave-(3). Minimum target for wave-(3) is 1.2618; the 1.618 extension is 1.2772,” Nomura projects.

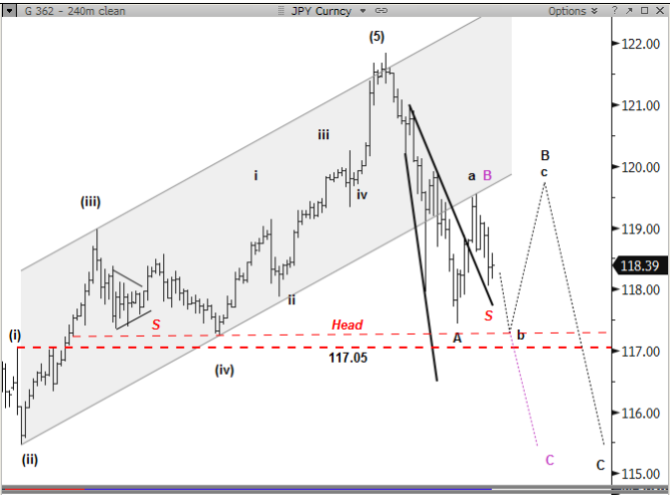

From an Elliott perspective, Nomura notes that USD/JPY range bound wave-B but there is equal chance that the recent pop satisfied all of wave-B.

“Prices will need to break 117.05 to raise conviction that wave-B is complete. S/t, support is 118.05/117.90 and resistance is 119.00. Our bias, in either scenario below, is for a move back to the low end of the range near 117.25/05,” Nomura projects.

“Last thing, we are also noting a possible head & shoulders top with neckline support at 117.25; this move lower would be the right shoulder,” Nomura argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.