While many see downside risks for EUR/USD, few are as bold as to set the following targets: 1.12 or 1.05 in case of QE, very close to parity.

The team at Morgan Stanley explain:

Here is their view, courtesy of eFXnews:

EUR is the most extreme short-positioned currency in the G10, notes Morgan Stanley.

“However, despite the latest readings of the MS FX Positioning Tracker showing there has been scaling back of EUR short positions, the EURUSD rebound has remained limited,” MS adds.

Short-lived corrections:

“In recent months, there have been a couple of examples of short EUR-position adjustment resulting in only limited correction rebounds. This we believe is evidence of the more structural outflows now developing from the Eurozone, keeping the EURUSD downtrend intact,” MS argues.

However, MS notes that EUR rebounds on several of the crosses looked more pronounced, keeping the EUR relatively higher on a trade-weighted basis.

The case for QE:

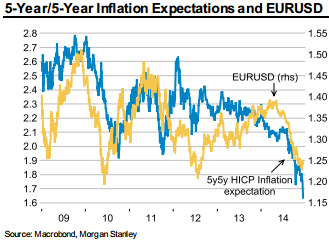

“This could increase market expectations that the ECB will announce QE in early 2015, capping any further EUR gains. Other indicators are also putting the pressure on the ECB to take further action, including the Eurozone 5-year/5-year Inflation expectations, which have also continued to fall sharply,” MS adds.

Politics matters too:

“The political uncertainty building within Europe is set to be a major theme over the coming year, we believe, where several elections are likely to highlight a shift away from mainstream parties towards smaller, often more EMUskeptical political parties, throughout Europe. This is likely to add to the longer-term EUR bearish theme, in our view,” MS expects.

EUR/USD forecasts for 2015: 1.12 without QE:

“As a result, we expect the EUR to come under continued pressure over the coming year and reiterate our view of EURUSD extended towards the 1.12 area. This base case projection assumes no QE from the ECB and is formed around the scenario that the current announced measures are set to weaken the EUR via portfolio outflows, increased bank lending (EUR used as a funding currency) and currency hedging of outstanding positions,” MS projects.

EUR/USD forecasts for 2015: 1.05 with QE

“However, if the ECB does move to QE in the coming months, this would likely take us to our 1.12 target more rapidly and put the focus on our EUR bear case scenario, where we project EURUSD down to 1.05 for end-2015,” MS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.