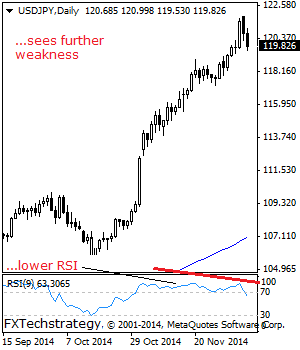

USDJPY: Having turned lower on Monday and followed through lower on correction during Tuesday trading session, further decline is envisaged. On the downside, support comes in at the 119.00 level where a break will target the 118.00 level. Below here if seen will aim at the 117.00 level followed by the 116.50 and then the … “USDJPY: Declines Further On Correction”

Month: December 2014

Euro Gets a Temporary Boost

Euro is heading higher today, gaining ground against most of its major counterparts, as commodities gain and as Forex traders consolidate previous positions. Earlier, the euro had reached a two-year low against the US dollar, falling on expectations that the Federal Reserve will raise rates sooner rather than later. However, after reaching that low, things started turning around when Forex traders began consolidating their … “Euro Gets a Temporary Boost”

US Dollar Mostly Lower on Profit Taking and Consolidation

Greenback is losing ground today, thanks in large part to profit taking and consolidation going on right now. At the end of last week, good economic news sent the US dollar soaring, but now it seems as though Forex traders are ready to take a step back and consolidate their positions. US dollar is mostly lower today as Forex traders and others consider their positions and take profits. Greenback is … “US Dollar Mostly Lower on Profit Taking and Consolidation”

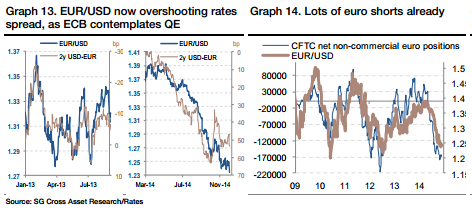

EUR/USD Set To Break 1.20: Will It Collapse? – SocGen

The common currency lost a lot of ground to the greenback in recent months, in a gradual yet consistent grind lower. Can it extend its falls and hit even lower ground. The team at SocGen discusses the potential downside and what does keep the euro bid: Here is their view, courtesy of eFXnews: EUR/USD is … “EUR/USD Set To Break 1.20: Will It Collapse? – SocGen”

Australian Dollar Drops Sharply with Business Confidence

The Australian dollar fell sharply today after the business confidence indicator of National Australia Bank dropped last month. It added to talks about a potential interest rate cut from Australia’s central bank. NAB Business Confidence, which held steady at 5 in October, dropped to 1 in November. The report noted: Firms uncertainty over the outlook for their industries was reflected in a further erosion of business confidence. Confidence levels vary … “Australian Dollar Drops Sharply with Business Confidence”

Yen Bounces from Multi-Year Lows

The Japanese yen bounced from multi-year lows today as the nation’s current account demonstrated a surplus that was about two times as big as forecasters have predicted. The currency managed to rally even as Japan’s economy continued to decline. Japan’s current account had an excess of ¥0.95 trillion in October. This is compared to the median forecast of ¥0.46 trillion. Meanwhile, gross domestic product shrank 0.5 percent in the second quarter of 2014 after … “Yen Bounces from Multi-Year Lows”

Australian economy braces for a cut in Interest rates

The latest quarterly GDP numbers from Australia hit the market last week coming in under analysts’ expectations, fuelling speculation that we may see an Interest rate cut form the RBA sometime next year. Interest rates have been on hold in Australia at 2.5% since August 2013. GDP figures for the September quarter came in at … “Australian economy braces for a cut in Interest rates”

Malaysian Ringgit Drops as US Jobs Growth Fuels Rate Hike Speculations

The Malaysian ringgit fell today, touching the lowest level since September 2009 against the US dollar, as the huge increase of US employment fueled speculations that the Federal Reserve will increase interest rates in the near future. The last week’s employment report from the United States reinvigorated talks about rate hike from the Fed, boosting the dollar. Meanwhile, the drop of prices for Brent crude oil hurt trading revenue for Malaysia, oil … “Malaysian Ringgit Drops as US Jobs Growth Fuels Rate Hike Speculations”

Rand Falls as South Africa’s Current Account Misses Estimates

The South African rand dropped today, reaching the lowest level since 2008 against the US dollar, as the nation’s current-account deficit narrowed less than was predicted by analysts. The current-account gap shrank to 6 percent of gross domestic product in the third quarter of this year from 6.3 percent in the previous three months. Specialists have promised a decline to 5.8 percent. This week should be important for the rand as Fitch Ratings and Standard … “Rand Falls as South Africa’s Current Account Misses Estimates”

Aussie Selloff Eases Even After Disappointing Forecasts

The Australian dollar was involved in a selloff last week, and it doesn’t appear that things are improving all that much as a new week begins. The Aussie is still just holding its own against major currencies, and the forecast doesn’t offer a whole lot in terms of encouragement for the Down Under currency. Australian dollar is struggling today, but the selloff easing as the situation continues to look disappointing for the Down Under economy. A surprise … “Aussie Selloff Eases Even After Disappointing Forecasts”