UK pound is gaining ground against its major counterparts today, thanks to improving data. Pound is doing especially well against the euro, thanks to better economic data and policy divergence. Sterling is mostly higher today, thanks in large part to recent economic data. Much of the recent data, from PMI to GDP, has been reasonably positive, especially when compared with what is happening in the eurozone. … “UK Pound Gains Ground Against Major Counterparts”

Month: December 2014

GBP/USD: Trading the British Manufacturing Dec 2014

British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the strength of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background The British … “GBP/USD: Trading the British Manufacturing Dec 2014”

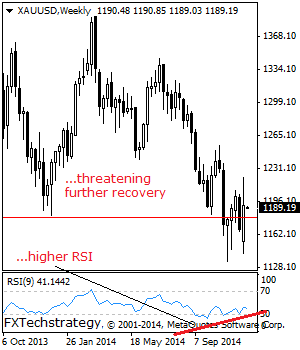

GOLD: Set To Extend Recovery

GOLD: With GOLD putting in a bottom the past week, risk of further upside should build up in the new week. On the upside, resistance lies at the 1,230.00 level where a break will aim at the 1,250.00 level. A break will target the 1,270.00 level followed by the 1,300.00 level. A cut through here … “GOLD: Set To Extend Recovery”

USD/JPY: Ignore S/T Charts; EUR/USD: Bullish & Bearish Signals

EUR/USD has reached new lows and USD/JPY is reaching high sky levels. Is it time for a pullback in both pairs or can we see a continuation coming soon? The team in TD weighs in: Here is their view, courtesy of eFXnews: EUR/USD retains a weak technical bias and short-term trend momentum is picking up … “USD/JPY: Ignore S/T Charts; EUR/USD: Bullish & Bearish Signals”

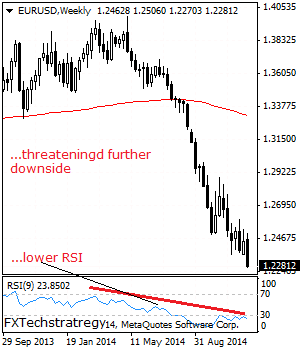

EUR/USD: Threatens Additional Price Declines

EURUSD: Having taken back its previous week gains at the end of the week, the pair faces the risk of further decline in the new week.However, beware of a corrective recovery threat in the new week. Support is seen at 1.2200 level with a cut through here opening the door for more downside towards the … “EUR/USD: Threatens Additional Price Declines”

Sell AUD/USD – Barclays’ Trade Of The Week

The Australian dollar has weakened quite a bit in the previous week, reaching new 4 year lows against the US dollar. Weak Australian GDP took its toll. Is this the end of it? The team at Barclays sees more drops and explains: Here is their view, courtesy of eFXnews: Investors following tactical strategies should consider … “Sell AUD/USD – Barclays’ Trade Of The Week”

Euro Ends Week with Losses vs. Dollar, Mixed Against Other Currencies

The euro demonstrated big losses against the US dollar this week, falling to the lowest level in more than two years. The euro’s performance against other currencies was mixed: the shared 18-nation currency ended the week lower against the Great Britain pound, flat versus the Australian dollar while against the Japanese yen, the euro reached a new multi-year high. Last week, analysts were expecting resumption of decline for EUR/USD, but … “Euro Ends Week with Losses vs. Dollar, Mixed Against Other Currencies”

CAD Touches Lowest Since 2009 vs. USD, Gains vs. EUR & JPY

The Canadian employment report was not nearly as good as the US one. As a result, the Canadian dollar dropped against the US dollar, touching the lowest level since July 2009. Surprisingly enough, the loonie managed to log gains against such major currencies as the euro and the Japanese yen. Canadian employment shrank by 10,700 in November from October, according to the Statistics Canada, even though specialists expected growth. As a result, the unemployment rate inched up … “CAD Touches Lowest Since 2009 vs. USD, Gains vs. EUR & JPY”

Dollar Settles Higher After Impressive NFP

The US dollar jumped to settle higher against the majority of other most-traded currencies due to overwhelmingly positive non-farm payrolls. While most analysts were optimistic about US employment, even they could not anticipate such impressive growth. Non-farm payrolls demonstrated amazing growth by 321,000 in November, beating the optimistic consensus forecast of 231,000. On top of that, the previous month’s figure was revised positively from 214,000 to 243,000. Surprisingly … “Dollar Settles Higher After Impressive NFP”

AUD/USD Continues To Face Downside Pressure

AUDUSD: With the pair remaining weak and vulnerable, we think it should still extend its downside pressure. On the downside, support lies at the 0.8350 level. A cut through here will turn attention to the 0.8300 level and then the 0.8250 level where a violation will set the stage for a re-target of the 0.8200 … “AUD/USD Continues To Face Downside Pressure”