The Australian dollar dipped today, falling to a new multi-year low against its US counterpart. The currency declined even though macroeconomic data from Australia was positive and should have supported the currency. Australian retail sales grew 0.4 percent in October, at the same rate as in the previous two months. The trade balance deficit shrank by A$0.91 billion to A$1.32 billion in October on a seasonally adjusted basis, more than analysts have predicted. … “Australian Dollar Dips as Fundamentals Fail to Support”

Month: December 2014

Yen Continues to Weaken Against Other Currencies

Yen continues to weaken against its major counterparts, falling lower on comments about inflation. It’s also not helping today that there seems to be a degree of risk appetite that means a lower yen in general. There isn’t a whole lot going for the yen right now. Indeed, even policymakers in Japan are working to keep the yen lower. Recently, Bank of Japan Board Member Takehiro Sato said that … “Yen Continues to Weaken Against Other Currencies”

FxPro awarded best FX Provider for 2014 at Investors

Forex broker FxPro collects another award, and quite a prestigious one: the Investors Chronicle & Financial Times Awards. This is not the first prize awarded to the firm. For more, here is the official press release: 03 December 2014, London. FxPro has been awarded ‘Best Forex Provider’ at the 2014 Investors Chronicle & Financial Times Investment … “FxPro awarded best FX Provider for 2014 at Investors”

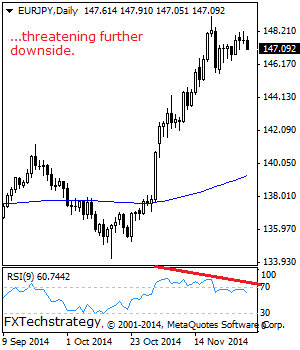

EUR/JPY: Weakens On Correction

EURJPY- With the cross declining on Tuesday on corrective pullback, further bearishness is now envisaged. On the downside, support comes in at the 146.50 level where a break will aim at the 145.00 level. A break will target the 144.00 level with a breach turning focus to the 143.00 level. On the upside, resistance resides … “EUR/JPY: Weakens On Correction”

Sterling Rallies with Help of Positive News from Britain

The Great Britain pound rallied today due to a positive report about the UK service industries and the upward revision of growth forecast. The currency managed to gain against almost all its most-traded peers, including the US dollar. The Markit/CIPS UK Services PMI climbed from 56.2 in October to 58.6 in November, far above analysts’ projections. Chancellor George Osborne was rather optimistic in his Autumn Statement 2014 speech to the Parliament. In particular, … “Sterling Rallies with Help of Positive News from Britain”

US Economic Indicators Remain Beneficial for Dollar

The US dollar gained against nearly all its major counterparts as US macroeconomic indicators continue to be beneficial for the currency. The Great Britain pound was among the few currencies that held ground against the greenback. Automatic Data Processing reported that US employers added 208,000 jobs in November. While the figure was somewhat below expectations, it still demonstrated solid performance of the US labor market. The services index … “US Economic Indicators Remain Beneficial for Dollar”

Commodity price weakness could be game changer for currencies

The recent rout in oil prices and that of a number of other key commodities could have some surprising ramifications for the forex markets next year. The obvious victims so far have been the commodity currencies, some of which have been hammered. If commodity prices are entering a long-term bear market that could have significant … “Commodity price weakness could be game changer for currencies”

GBPJPY: Bullish, Faces Upside Risk

GBPJPY: With the cross remaining biased to the upside, further strength is envisaged. On the upside, resistance lies at the 187.00 level followed by the 188.00 level where a break will aim at the 189.00 level. A cut through here will aim at the 190.50 level. On the downside, support comes in at the 185.50 … “GBPJPY: Bullish, Faces Upside Risk”

Loonie Recovers to Some Degree

The Canadian dollar has been struggling recently, but seems to be enjoying something of a breather right now. The loonie is a little bit higher against the US dollar, thanks in part to slightly higher oil prices today, as well as some profit taking. Recent losses to oil have impacted the Canadian dollar quite a bit. The Canadian economy relies heavily on oil, and when oil prices drop, the loonie tends to follow suit. … “Loonie Recovers to Some Degree”

Euro Falls Across the Board Ahead of ECB

Speculation is running high that the ECB will announce more easing actions after its policy meeting tomorrow. As a result of poor economic data, the euro is at its weakest in more than 24 months, and many expect more weakness from the 18-nation currency. Tomorrow, ECB President Mario Draghi will announce what’s next for monetary policy in the eurozone. Many expect that policymakers will announce further efforts … “Euro Falls Across the Board Ahead of ECB”