Once again, economic data out of the eurozone is causing concern for Forex traders and investors. However, the disruption isn’t as widespread as some might think. Rather than trading down across the board, the euro is trading mixed against its major counterparts. The latest producer prices data fell again, declining from September to October, according to Eurostat. A 4.0 per cent decline was greater than the expected 0.3 per … “Euro Trades Mixed After Producer Prices Data”

Month: December 2014

Previews of December’s big events – Market Movers #27

The ECB meeting and the NFP are the first big events of a busy last month of the year. We preview the big events that rock markets. We also look back at the meaning of crashing oil to markets, and the negative GOFO rates and what it means for oil. And towards the NFP, we look at … “Previews of December’s big events – Market Movers #27”

USD/JPY: Trading the ISM Services PMI Dec 2014

The ISM Non-Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers, excluding the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Update: ISM Non-Manufacturing PMI jumps to 59.3 points … “USD/JPY: Trading the ISM Services PMI Dec 2014”

Aussie Rises for Second Day, Gets Help from Fundamentals

The Australian dollar rallied today, rising for the second consecutive trading session. The currency advanced as the central bank left interest rates unchanged while macroeconomic indicators exceeded economists’ expectations. The RBA kept the main cash rate unchanged at 2.5 percent at today’s policy meeting. The central bank said in the statement that “growth in the global economy is continuing at a moderate pace” and in Australia “most data are consistent with moderate growth in the economy.” … “Aussie Rises for Second Day, Gets Help from Fundamentals”

Yen Gains, Under Pressure from Credit Rating Downgrade

The Japanese yen rallied yesterday and maintained its gains today. The currency was under pressure after Moody’s Investor Service decided to cut Japan’s credit rating on Monday. The yen remained soft against the Great Britain pound. Moody’s decided to slash Japan’s debt rating by one notch to A1 from Aa3, keeping the outlook stable. The rating agency explained its decision by following considerations: 1. Heightened uncertainty over the achievability … “Yen Gains, Under Pressure from Credit Rating Downgrade”

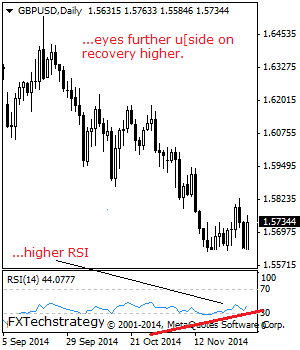

GBP/USD: Triggers Recovery Higher

GBPUSD: Although GBP maintains is broader medium term downtrend, the reversal of its Friday losses on Monday is suggestive of further recovery higher. On the downside, support lies at the 1.5650 level where a break will aim at the 1.5600 level where a break will aim at the 1.5550 level. A break of here will … “GBP/USD: Triggers Recovery Higher”

AUD/USD: Trading the Australian GDP Dec 2014

Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity. A reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP Dec 2014”

Aussie Bounces from Multi-Year Low

The Australian dollar managed to bounce after the initial drop today. The currency rose even though fundamentals were not particularly supportive. The Aussie dropped to the new multi-year low against the US dollar previously. Growth of the manufacturing sector in China slowed last month, worsening prospects for Australian exports. The Asian country is the biggest trading partner of Australia. On top of that, the Swiss referendum hurt prices for gold. This added to the bearish momentum … “Aussie Bounces from Multi-Year Low”

Swiss Franc Higher After Referendum

The Swiss franc fell initially today after yesterday’s referendum resulted in no change to the central bank’s regulations. The currency gained ground right now, rising against its major peers, including the US dollar and the euro. Among topics for voting on the referendum was the legislation that would increase the minimum share of central bank’s reserves that should be allocated in gold. Experts speculated that such rule would make it … “Swiss Franc Higher After Referendum”

Weak commodity prices pressure the Australian economy

The Australian dollar touched its lowest level since July 2010 as tumbling commodity prices including oil put severe pressure on the commodity currency and left analysts to wonder when the rout will stop At 9.12pm (AEDT) the Aussie dollar was trading at US84.93 US cents after falling as low as US84.17 cents and down fromUS85.02 … “Weak commodity prices pressure the Australian economy”