The Indian rupee dropped today for the fourth straight session. Market analysts speculated that the currency dropped as importers were buying dollars to pay for their bills by the end of the year. It is not uncommon for the Forex market to react to the year-end by wild swings as companies buy currencies to fulfill their payment obligations. At the same time, thin trading volume due to the holiday season calms volatility as liquidity is low. Nevertheless, today’s drop … “Indian Rupee Drops due to Year-End Dollar Buying”

Month: December 2014

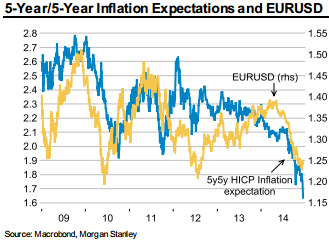

EUR/USD To Fall To 1.12 Without QE Or 1.05 With

While many see downside risks for EUR/USD, few are as bold as to set the following targets: 1.12 or 1.05 in case of QE, very close to parity. The team at Morgan Stanley explain: Here is their view, courtesy of eFXnews: EUR is the most extreme short-positioned currency in the G10, notes Morgan Stanley. “However, … “EUR/USD To Fall To 1.12 Without QE Or 1.05 With”

Dollar Retains Strength During Quiet Trading Week

The US dollar closed higher against its major peers this week even though initially, it looked that the rally had lost steam. US macroeconomic indicators were mixed, but the market paid attention to the positive ones for the most part. At first, it looked like the US currency lost its upward momentum. Yet in the end, the greenback was able to maintain its rally. Economic reports from the United … “Dollar Retains Strength During Quiet Trading Week”

Yen Falls vs. Dollar on Poor Data, Stays Resilient vs. Pound & Euro

The Japanese yen fell against the US dollar and the Great Britain pound today due to negative macroeconomic data. The drop was small, and the currency managed to gain against the euro. Almost all today’s reports from Japan were bad. Inflation slowed while both average cash earnings and industrial production dropped unexpectedly. The data suggests that Japan’s path to economic recovery is not straightforward and there will be difficulties. … “Yen Falls vs. Dollar on Poor Data, Stays Resilient vs. Pound & Euro”

Ruble Halts Its Impressive Rally

The Russian ruble sank today, halting it biggest weekly rally in 16 years. The drop was substantial though it did not erase the weekly gain completely. The ruble was rallying with the help of Russia’s government and the central bank. Yet without fundamental reasons for a rally, it was hard to the Russian currency to continue move up. The ruble lost 38 percent of its value in 2014 — the worst year since 1998 … “Ruble Halts Its Impressive Rally”

Malaysian Ringgit Gains After Excessive Losses

The Malaysian ringgit gained today, demonstrating the biggest gain in a week, following its previous losses. The most likely reason for the rally is that the market considered the previous decline excessive. Analysts think that today’s gains of the ringgit were just a technical bounce due to the oversold status of the currency. Traders were selling the ringgit earlier because of the drop of oil prices and the outlook for monetary tightening from the Federal Reserve. The currency is still … “Malaysian Ringgit Gains After Excessive Losses”

5 EUR/USD Downside Drivers & Targets – Nomura

The euro remains pressured to the downside and it may not be all over. The team at Nomura present 5 downside drivers for EUR/USD and describe the lower targets: Here is their view, courtesy of eFXnews: It took fairly severe risk aversion to see a squeeze in EURUSD up to above 1.25 earlier this week; and … “5 EUR/USD Downside Drivers & Targets – Nomura”

Turkish Lira Drops as Central Bank Refrains from Action

The Turkish lira fell today after yesterday’s decision of the nation’s central bank to keep its borrowing costs stable. Policy makers refrained from action even as inflation accelerated due the drop of the currency. The Central Bank of the Republic of Turkey kept all of its interest rates unchanged during yesterday’s meeting and said that “the tight monetary policy stance will be maintained”. The outlook for monetary tightening from the Federal Reserve drove … “Turkish Lira Drops as Central Bank Refrains from Action”

Ruble Gains for Fifth Day

The Russian ruble gained today amid speculations that the government forced domestic exporters to sell foreign currencies. The ruble gained 15 percent over the last five trading sessions. According to a report, Russia ordered companies to convert their overseas earnings into the local currency. It is an attempt to support the ruble that has been falling due to economic sanctions from the United States and the European Union as well as because of the drop … “Ruble Gains for Fifth Day”

Dollar Remains Below Opening Level, Losses Limited

The US dollar remained below the opening level for the duration of the current trading session. Losses were small, though, and the currency remains among the best performers on the Forex market. The dollar started the session with losses and came to the end of the session remaining below the opening level. Yet the drop looks like a small correction during a strong bull move, not a reversal of the upward trend. Overall, the trading environment remains extremely positive for the US currency. … “Dollar Remains Below Opening Level, Losses Limited”