Euro continues to struggle, turning in a mixed performance today. The 18-nation currency is finding it difficult to maintain gains as concerns about the economy continue to rise. While the euro is turning in a slightly stronger performance against the US dollar today, it’s not likely to last. The eurozone appears stuck in economic doldrums. The International Monetary Fund expects to see eurozone growth of 1.3 per cent in 2015 — leaving it behind as the global … “Euro Continues to Struggle; Likely to Struggle in 2015”

Month: December 2014

Dollar Backs Off Following Gains, Remains Strong

The US dollar is backing today after yesterday’s gains. Yet the currency is still strong, trading near a new multi-year high against the euro, following some positive reports from the United States. The major indicator that drove the dollar up was gross domestic product. GDP rose 5 percent in the third quarter of this year, beating market expectations. The University of Michigan consumer sentiment index was also … “Dollar Backs Off Following Gains, Remains Strong”

Divergence, Deflation and the Dollar – 2014 in Forex

For the forex markets 2014 can be largely summed up in just two words: Divergence and Deflation. It was also the year of the USD, which enjoyed a spectacular rally. The USD index was around 80 at the end of December 2014 and by the end of December 2015 it was 89.60 with it really … “Divergence, Deflation and the Dollar – 2014 in Forex”

EUR/USD: Trading the US Unemployment Claims Dec 2014

US Unemployment Claims is released weekly, and measures the number of people filing for unemployment for the first time. It is considered an important measure of the health and direction of the US economy. A reading which is higher than the market forecast is bullish for the euro. The indicator is usually released on Thursdays, … “EUR/USD: Trading the US Unemployment Claims Dec 2014”

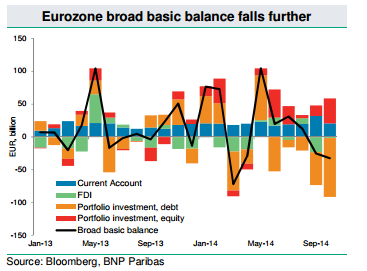

We Stay Short EUR/USD; More Reasons To Be Short EUR

If you needed more reasons to understand the euro’s move south and EUR/USD grind lower, the team at BNP Paribas provides explanations. And, they also have a trade setup for EUR/USD: Here is their view, courtesy of eFXnews: October’s balance of payments data continues to suggest real flow support for the EUR is waning, notes … “We Stay Short EUR/USD; More Reasons To Be Short EUR”

NZD Gains as New Zealand Trade Deficit Shrinks

The New Zealand dollar climbed today as the nation’s trade balance deficit shrank last month more than analysts have expected. It was the first daily gain in three sessions against the US dollar and the fifth consecutive advance against the Japanese yen. The New Zealand trade balance demonstrated a shortage of NZ$213 million in November, down from NZ $911 million in October. Experts predicted the value of NZ$550 million. The report was … “NZD Gains as New Zealand Trade Deficit Shrinks”

US Dollar Trades Mixed in Sign of What Could Come in 2015

US dollar is trading mixed today, and that could be a sign of what could come in 2015. Indeed, while the dollar is expected to remain relatively strong, it is likely to do so in fits and starts, and the recent rally will be hard to maintain as long as the Federal Reserve remains “patient.” Much of the dollar’s recent rally strength has come from expectations of policy divergence. The Federal Reserve is expected … “US Dollar Trades Mixed in Sign of What Could Come in 2015”

Malaysian Ringgit Suffers from Lower Oil Prices

The Malaysian ringgit dropped for the third straight session today on concerns that the drop of oil prices will hurt the trade balance of the oil-exporting country. Some of the major OPEC members reiterated yesterday that they are not going to cut production and some of them are even going to increase output. The statement renewed concerns about decline of crude oil prices. Analysts say that Malaysia, being oil-producing country, may be … “Malaysian Ringgit Suffers from Lower Oil Prices”

Euro regains ground, but not for long

Euro is gaining a little ground today, heading higher thanks to some improved data, and better risk appetite. However, the euro’s new found gains are likely to be short lived, since the 18-nation currency remains on shaky ground. Better economic data is beginning to help the euro a little bit in currency trading on the FX market. However, the small gains made today aren’t expected to last. Many predict more … “Euro regains ground, but not for long”

Taiwan Dollar Unable to Hold Ground vs. US Counterpart

The Taiwan dollar fell today on concerns that foreign investors will abandon local assets because of expectations of higher interest rates in the United States. Other currencies of emerging markets were also under pressure though some of them showed resilience. Prospects for monetary tightening from the Federal Reserve made the trading environment unfavorable for riskier currencies. While some of them, including the Indian rupee, were able to resist the pressure, the Taiwan … “Taiwan Dollar Unable to Hold Ground vs. US Counterpart”