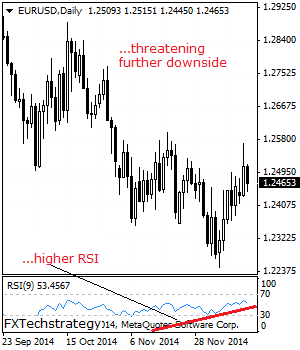

EURUSD: Having taken back some of its intra day gains on Tuesday and weakening during Wednesday trading session, further weakness is envisaged. On the upside, resistance lies at the 1.2569 level where a violation will aim at the 1.2600 level where a break will aim at the 1.2650 level, its psycho level followed by the … “EURUSD: Vulnerable On Price Failure”

Month: December 2014

USD/JPY: Trading the Philadelphia Index December 2014

The Philadelphia Fed Manufacturing Index is an important leading indicator, based on a survey of manufacturers in the Philadelphia area. It examines manufacturers’ opinions of business activity, and helps provides a snapshot of the health of the manufacturing sector. A reading which exceeds the forecast is bullish for the dollar. Update: Philly Fed Manufacturing Index slides … “USD/JPY: Trading the Philadelphia Index December 2014”

Euro’s Performance Resumes Downward Trend

Earlier, the euro saw some gains against its major counterparts. Right now, though, the euro is resuming its downward trend, losing ground to most of its major counterparts. Concern about the euro, and policy divergence, are weighing on the 18-nation currency. The latest economic data out of the eurozone indicates that the economy is still expanding, albeit slowly. However, after the initial impact of the good news was over, the euro … “Euro’s Performance Resumes Downward Trend”

Dollar Bounces After Decline

The US dollar bounced today following the decline during the previous trading session. The drop was a result of somewhat disappointing housing data from the United States. US building permits fell from 1.09 million in October to 1.04 million in November. Housing starts declined from 1.05 million to 1.03 million. Both readings were a bit below expectations. The report resulted in a drop of the US currency against major peers though the dollar … “Dollar Bounces After Decline”

Pound Mixed Following Poor Economic Data

The Great Britain pound was mixed today following yesterday’s surprisingly strong performance. The sterling was resilient during the previous trading session even though macroeconomic data from the United Kingdom was disappointing. Britain’s Consumer Price Index rose just 1.0 percent in November. This is compared to the median forecast of 1.2 percent and the previous month’s increase of 1.3 percent. The report cited following reasons for the slowdown: Falls in transport … “Pound Mixed Following Poor Economic Data”

NZD/USD: Trading the New Zealand GDP December 2014

New Zealand Gross Domestic Product (GDP) is a key release, released each quarter, which measures production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the New Zealand dollar. Here are all the details, and 5 … “NZD/USD: Trading the New Zealand GDP December 2014”

AUD/USD Next Targets Down Under – Morgan Stanley Chart

What’s next for the Australian dollar? It probably has more room on the downside. The team at Morgan Stanley provides 3 charts and various targets for the Aussie $: Here is their view, courtesy of eFXnews: Morgan Stanley picks AUD/USD as its technical FX chart of the week, where MS is bearish and looking to chase to … “AUD/USD Next Targets Down Under – Morgan Stanley Chart”

EUR/USD: A Low In For The Year? Ending Wedge –

EUR/USD has made a nice recovery from the lows. Is it all over for a new fall in the world’s most popular pair? The team at Goldman Sachs examines the wedge: Here is their view, courtesy of eFXnews: EUR/USD closed above the top of the pattern last Wednesday, re-tested the break point on last Thursday and … “EUR/USD: A Low In For The Year? Ending Wedge –”

Loonie’s Struggles Continue as Oil Continues to Fall

Canadian dollar continues to struggle in Forex trading, thanks in large part to falling oil prices. There doesn’t seem to be a bottom to the oil collapse, and the loonie is most lower against its major counterparts as a result of the oil weakness. There isn’t much to support the Canadian dollar in currency trading right now. The Bank of Canada isn’t expected to raise rates anytime particularly soon, and oil prices are dragging on the economy and the loonie. Oil … “Loonie’s Struggles Continue as Oil Continues to Fall”

EUR/USD: Wave-3 Correction; USD/JPY: H&S Top – Nomura

In two major pairs, the team at Nomura finds very interesting patterns. These are a wave 3 correction in EUR/USD and a Head & Shoulders top in USD/JPY. Here are the charts and the explanations: Here is their view, courtesy of eFXnews: In EUR/USD, Nomura still holds the view that the falling wedge from October fits … “EUR/USD: Wave-3 Correction; USD/JPY: H&S Top – Nomura”