The Japanese yen rose against other majors today, though the currency retraced its gains versus the US dollar as of now. The rally followed the victory of Japan’s Prime Minister Shinzo Abe in the snap elections over the weekend. Abe’s gamble to call a snap election has paid off as his party won the majority in the parliament. While the yen rallied after the news, analysts think that the outcome is negative for the Japanese currency in a long … “Yen Gains After Abe Wins Elections”

Month: December 2014

Australian dollar comfortable at US 75 cents according to

The Australian dollar took a hit last week as the US economy continued to gather momentum and the market reacted to more downbeat comments from RBA governor Glen Stevens about the value of the local currency. At last Fridays close the Aussie dollar was trading at US82.44 down from the previous week’s close of US83.11 … “Australian dollar comfortable at US 75 cents according to”

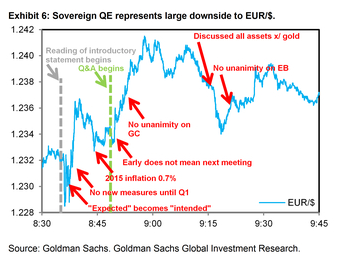

EUR/USD Price Action: ECB QE Not Priced In; Here Is

EUR/USD managed to recover from the lows despite the poor TLTRO and the diverging paths of monetary policies. The team at Goldman Sachs explains why there is a large downside to the pair with sovereign QE looming: Here is their view, courtesy of eFXnews: “We study tic-by-tic moves in the Euro during last week’s ECB press conference, … “EUR/USD Price Action: ECB QE Not Priced In; Here Is”

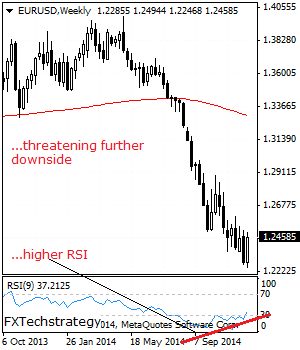

EURUSD: Bullish On Recovery Higher

EURUSD: Having reversed its previous week losses to close higher on Friday, it now faces further recovery bias. However, a mild pullback could occur before more strength is seen in the new week. On the upside, resistance lies at the 1.2500 level where a violation will aim at the 1.2550 level where a break will … “EURUSD: Bullish On Recovery Higher”

Dollar Loses Bullish Momentum, Falling Over Week

The US dollar lost its bullish momentum, falling this week. Macroeconomic reports from the United States were good for the most part, indicating continuing growth of the US economy, but even they did not help the currency. This week was marked by risk aversion due to falling oil prices and concerns about the global economy and China’s growth in particular. Macroeconomic data showed that inflation is slowing in the Asian … “Dollar Loses Bullish Momentum, Falling Over Week”

USD strength could trigger emerging market crisis sending it

It seems impossible for the USD to move in any right direction for emerging markets with it blamed for causing inflation when it falls and now it’s the culprit for a potential crisis in some developing countries which have borrowed in the US currency. The bad news for them is that the greenback is likely … “USD strength could trigger emerging market crisis sending it”

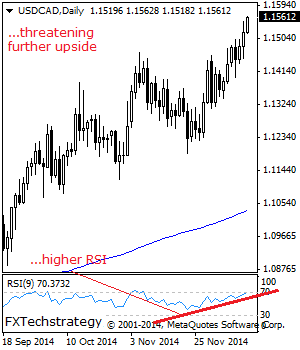

USD/CAD Bullish, Risk Points Higher

USDCAD: With continued upside offensive seen, further bullishness is envisaged. On the upside, resistance is seen at the 1.1600 level followed by the 1.1650 level. Further out, resistance comes in at the 1.1700 level where a turn lower may occur. But if further recovery is triggered resistance comes in at the 1.1750 level. On the … “USD/CAD Bullish, Risk Points Higher”

Interview with Itai Furman, Run down of TLTRO, NFP and

Itai Furman, a treasurer at Intel, lays out his views on investing, market liquidity, the impact of the Fed on money markets and lots more. In addition to his interesting insights, we run down the recent market events: excellent US job numbers, the ECB’s TLTRO and its implications, and also a run down on what’s running down: oil. … “Interview with Itai Furman, Run down of TLTRO, NFP and”

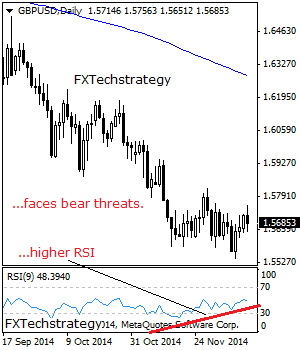

GBP/USD Loses Upside Steam

GBPUSD: Unless GBP breaks and holds above its intra day high at 1.5756 level, it faces a return to the downside in the days ahead. On the downside, support lies at the 1.5600 level where a break will aim at the 1.5550 level where a break will aim at the 1.5600 level. A break of … “GBP/USD Loses Upside Steam”

EUR/USD: Trading the UoM Consumer Sentiment December 2014

University of Michigan Consumer Sentiment surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US consumer confidence rises to 93.8 – USD stronger Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the UoM Consumer Sentiment December 2014”