US dollar is trading mixed today, and the US dollar index is down, thanks to a lot of the upheaval in the world right now. Greenback is trying to push higher after losing ground recently, and the results depend largely on a number of global factors. It’s been an interesting week so far, as the US dollar has seen a great deal of weakness. Oil and gold prices remain choppy, and that is impacting the US dollar. … “Greenback Continues to Look for Direction”

Month: December 2014

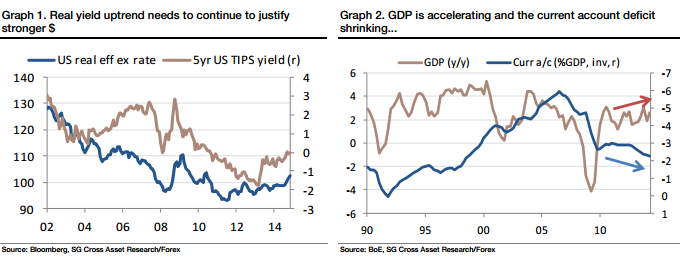

USD bullish view for 2015 is probably right – SocGen

When everybody says the same thing, there is room for suspicion. If everybody is long the dollar, who’s left to buy? Well, in some cases, there are good reasons for the consensus. In the case of the US dollar for 2015, the team at SocGen asks these questions and explains why this bullish USD view could … “USD bullish view for 2015 is probably right – SocGen”

TLTRO: 3 scenarios for EUR/USD

For the euro, the big event of the week is the second TLTRO operation. The stakes are high: a big take up would push back QE and help the euro, while a small one would make it imminent. So what numbers can we expect? Here is some background, the uphill struggles that the ECB faces and … “TLTRO: 3 scenarios for EUR/USD”

Australian Dollar Retreats After Rally

The Australian dollar went down after the initial spike today. The currency rallied after the surprisingly good employment report but was unable to sustain gains. The Aussie traded below the opening level against the US dollar and the euro but hangs above the opening versus the Japanese yen. Australian employers added as much as 42,700 jobs in November compared to the previous month’s increase of 15,200. Still, the unemployment rate ticked up by 0.1 percentage … “Australian Dollar Retreats After Rally”

NZ Dollar Rallies as RBNZ Promises Interest Rate Hikes

The New Zealand dollar rallied today after the Reserve Bank of New Zealand decided overnight to keep its key interest rates unchanged. While the currency came down from its high for the day against the US counterpart, it remains above the opening level. The RBNZ decided to keep its Official Cash Rate at 3.5 percent. Governor Graeme Wheeler said in the statement about the world’s economic growth: The global economy continues … “NZ Dollar Rallies as RBNZ Promises Interest Rate Hikes”

Australian Dollar Bounces Resisting Pressure from Fundamentals

The Australian dollar bounced today after initial drop even though not all economic reports from Australia were helpful for the currency. The bounce does not look impressive, though, compared to the recent streak of losses. The Westpac-Melbourne Institute Consumer Sentiment Index fell 5.7 percent in December. The report said: This is a very disturbing result. The Index is now at its lowest level since August 2011. As a piece of good … “Australian Dollar Bounces Resisting Pressure from Fundamentals”

Yuan Gains Even as Inflation Slows

The Chinese yuan gained today even though macroeconomic indicators were negative for the currency. Consumer inflation slowed unexpectedly and producer prices continued to fall. The Consumer Price Index rose 1.6 percent in November from a year ago while analysts have expected inflation to stay at the previous month’s level of 1.4 percent. Consumer prices fell 0.2 percent month-on-month. The Producer Price Index dropped 2.7 percent last month from … “Yuan Gains Even as Inflation Slows”

UK Pound Gains Some Ground

It’s been a bit of a rough go for the UK pound recently, but the sterling is currently gaining some ground on the Forex market. While trading mixed today, sterling is a little higher against the euro and the US dollar. Recent economic data out of the United Kingdom has been disappointing, and that has been weighing on the pound recently. Manufacturing data recently missed expectations, and the Bank of England continues to stay the course. Indeed, … “UK Pound Gains Some Ground”

EUR/USD: 2015 Views & Targets – Deutsche Bank

The euro managed to stage a recovery, but there are doubts if this can continue. The team at Deutsche Bank looks into 2015, explains its rationale for the next moves and sets quarterly targets: Here is their view, courtesy of eFXnews: Near-term, Deutsche Bank thinks that the recent pause in EUR/USD drop could extend into year-end … “EUR/USD: 2015 Views & Targets – Deutsche Bank”

AUD/USD: Trading the Australian jobs Dec 2014

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Dec 2014”