EUR/USD began 2015 with a storm and already reached the lowest levels since 2010. Comments by Draghi are one reason, but not the only one.

The tam at Nomura provides a much bigger issue for the single currency:

Here is their view, courtesy of eFXnews:

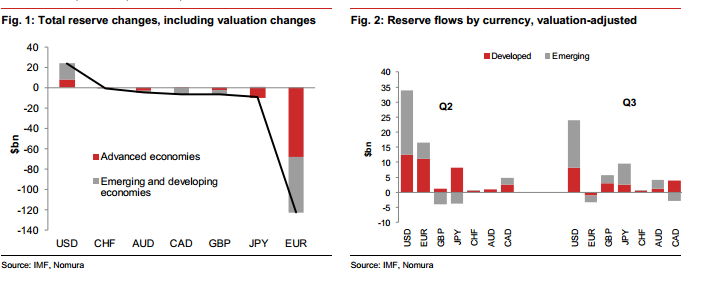

Every quarter the IMF puts out a snapshot of global central bank reserve composition (with a quarter lag), and this week we got the Q3 numbers which seem to signal a shift in central bank behavior, notes Nomura.

“Normally, central banks operate with fairly fixed currency allocation targets, and when a currency goes down in value, they accumulate, to stabilize its share. In Q3, the Euro dropped sharply vs the dollar, but both G10 and EM central banks were on the margin active sellers of Euro’s,” Nomura explains.

“According to IMF COFER data published today, the Euro share of global reserves dropped 1.5 percentage points to 22.6%. This is one of the largest quarterly declines in the share ever,” Nomura clarifies.

“This is a big deal, as it suggest ‘portfolio rebalancing’ has been put on hold. This means that stabilizing flows, which could have been in the region $100bn, are not materializing,” Nomura argues.

“If this is indeed the new trend, there may be potential for a faster move lower in the Euro in early 2015, driven more purely by private sector flows,” Nomura projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.