Yes, the dollar ran higher and higher, but it probably is not enough. And it is not only a euro story, or weaker China hitting the Australian dollar, oil hitting the loonie and elections weighing on the pound.

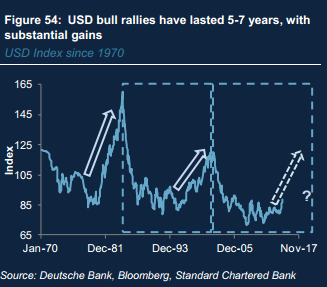

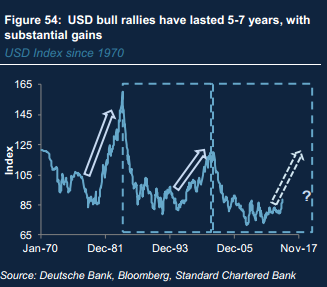

If this is a historic dollar cycle, there is so much room to run. The team at Standard Chartered explain with a chart:

Here is their view, courtesy of eFXnews:

“Another secular USD bull rally in the making? USD secular rallies in the past have been spread out over 5-7 years, with gains of 40-70%. Moreover, USD bull/bear cycles have followed similar patterns in the past. After the recent rally, the USD is 22% higher than trough levels in 2011, which is still modest compared with previous episodes.

USD still cheap relative to history? Despite its recent gains, the USD still cannot be considered expensive. Other major currencies such as the EUR and JPY have appreciated considerably compared with the USD on a trade-weighted (TW). Despite its recent rally, the USD TW index is still below the JPY and EUR equivalents measured since 2001. Other valuation measures, including Purchasing Power Parity (PPP), also show that the USD remains inexpensive relative to history

Our outlook: We believe the USD is on a multi-year appreciation path. In our opinion, economic and policy divergence with other major economies will drive capital into the US, seeking higher asset returns and productivity. The US current account deficit will continue to improve owing to lower oil prices. We believe recent gains in the USD are modest on a TW basis and not significant enough to erode competiveness.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.