While EUR/USD managed to bottom out after the mixed Non-Farm Payrolls report, this is not necessarily a long lasting bounce.

Euro/dollar parity is no longer ruled out in the longer term, and the bank provides targets for the shorter term as well as explanations for the downgrade of forecasts:

Here is their view, courtesy of eFXnews:

The last time Goldman Sachs made a meaningful downward revision to its EUR/USD forecast was back in August, just after ECB President Draghi’s speech at Jackson Hole. At the time, GS’ message was that EUR/USD has begun a protracted weakening trend, reflecting cyclical underperformance vis-à-vis the US and a more activist ECB, which would take the single currency to parity versus the Dollar by 2017.

Today GS revised down its EUR/USD forecasts further: Here are GS’ rationale behind this revision along with its new forecasts.

Growth & Competitiveness Crisis Continues Unabated:

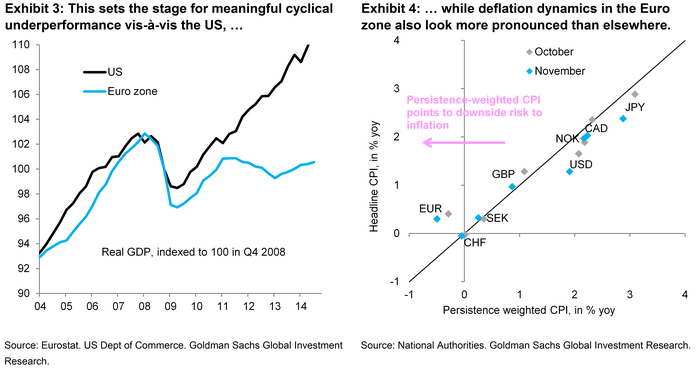

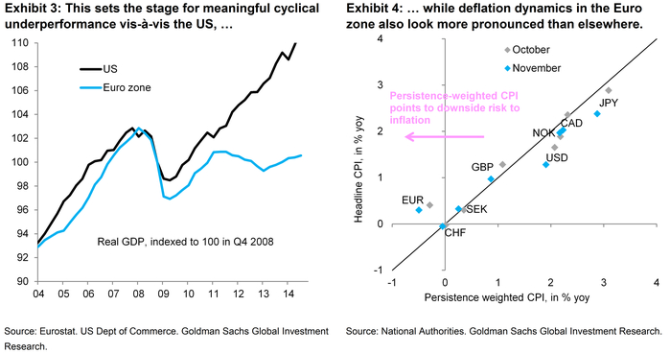

“The sovereign debt crisis in Europe arguably ended mid-2012 with President Draghi’s important “whatever it takes” speech and the subsequent creation of the OMT program. However, a growth and competitiveness crisis continues unabated, and this forms the backbone of our EUR/$ lower vi ew. This sets the stage for protracted cyclical underperformance vis-à-vis the US (Exhibit 3) and deflation / disinflation, which our persistence-weighting makes out to be the most severe in the G10 (Exhibit 4), even before recent sharp falls in oil prices,” GS argues.

ew. This sets the stage for protracted cyclical underperformance vis-à-vis the US (Exhibit 3) and deflation / disinflation, which our persistence-weighting makes out to be the most severe in the G10 (Exhibit 4), even before recent sharp falls in oil prices,” GS argues.

EUR/USD Undershoot ‘Fair Value’:

“As a result, we see the recent slide in the single currency as part of a broad trend, which will see EUR/$ undershoot ‘fair value’ (around 1.20, based on our GSDEER model) on the weak side for a protracted period. In particular, we think that if ECB policies manage to convincingly raise inflation expectations, EUR/$ may fall more than implied by nominal rate differentials,” GS adds.

New Forecasts:

“We are revising down our forecast further today, to 1.14, 1.11 and 1.08 in 3, 6 and 12 months (from 1.23, 1.20 and 1.15 before). We are also revising down our longer-term forecasts, bringing the end-2016 forecast to 1.00 (from 1.05) and that for end-2017 to 0.90 (from 1.00),” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.