USD/JPY has been stuck in some kind of range of late, after a long period of gains. What do the technical levels say?

The team at Goldman Sachs offers an in-depth technical analysis for the pair:

Here is their view, courtesy of eFXnews:

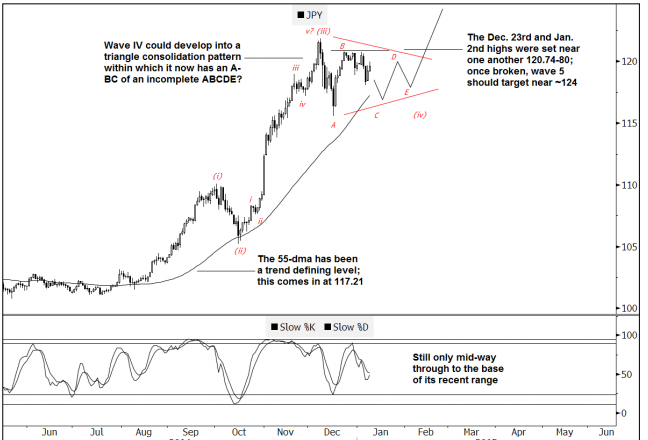

USD/JPY seems to be consolidating into the 4th wave of a sequence which began in July, notes Goldman Sachs.

“There have been two highs set against 120.74-120.80 on Dec. 23rd and Jan. 2nd which if broken should ultimately suggest that the final impulsive leg higher is likely underway,” GS adds.

“For now, it appears to be an unfinished ABCDE pattern which might need to consolidate further before resuming it’s underlying trend. The 55-dma should act as important support, currently at 117.21; it has held all of the lows since the start of the current wave count in Jul. ‘14,” GS adds.

Beyond this near-term price action, GS thinks that the ultimate target appears to be ~124.

“This level includes a 2.618 extension target for wave 5 (and v) of a sequence that began in ‘12 (and a minor one from Jul. ‘14). It also satisfies the target for a very large declining wedge formed off the peak in Jul. ’07 (124.14). All in all, it’s really the ideal target for one final up thrust in USDJPY,” GS projects.

“Once ~124 has been reached (and/or signs of a material top develop), it could eventual mean the end of the rally for some time and the start of a multiyear period of correction/consolidation,” GS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.