What type of QE will the ECB announce? Will it actually delay the decision to March? What is and what isn’t priced in?

The team at Morgan Stanley provide a guide map to trading the ECB decision on Thursday:

Here is their view, courtesy of eFXnews:

While the precipitous decline in crude prices has continued to capture market attention in the early days of 2015, FX markets will be very much focused this week on the January ECB meeting, says Morgan Stanley.

“The focus on the meeting has sharpened following the SNB’s decision to remove the floor on EUR/CHF, which has resulted in broader – and continued – EUR weakness and increased volatility in global FX market,” MS adds.

MS Base Case:

“Our economists’ base case remains that the ECB announces QE in March, with a strong easing signal next week,” MS projects.

Market Reaction:

“In that scenario, we would anticipate a broad waning of risk appetite given the recent build-up of market expectations. JPY and USD would rally on safe-haven inflows, while highyield G10 and EM would suffer. We would also sell any kneejerk EUR rally as structural outflows would dominate,” MS adds.

Alternate Case:

“However, an aggressive ECB program this week would represent another major phase in the global trade of deflation, likely raising pressure on other central banks that face similar deflationary threats,” MS clarifies.

Market Reaction:

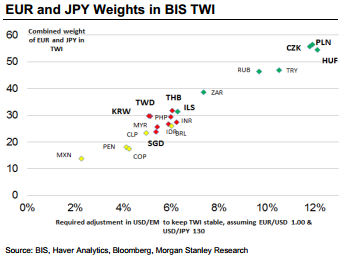

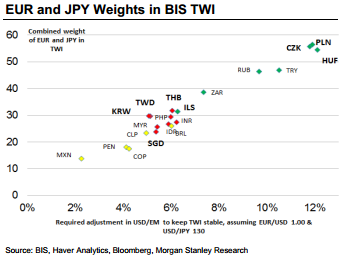

“Risk appetite would be likely supported in this scenario and we would expect EUR/USD to head towards our bear case of parity, while USD/JPY would also rise in sympathy. USD/CEE currencies would be most sensitive to a EUR decline, though AxJ currencies would, in time, suffer too. Currencies with few links to the EUR and with minimal deflationary risks would likely outperform,” MS projects.

The Trades:

As such, going into the ECB meeting, MS recommends being short EUR/INR which MS expects would head lower in the event that ECB is more aggressive than current market expectation. Along with that MS runs a limit order in its strategic portfolio to sell EUR/USD bounces at 1.1850 targeting a move to 1.0050, with a stop at 1.2150.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.