EUR/USD fell quite a lot after the announcement of massive Quantitative Easing by Mario Draghi, but after the pair reached a trough of 1.113 it made a huge rebound before sliding back down.

Forex trading is never a one way street.How can euro/dollar be traded? Morgan Stanley suggests a strategy:

Here is their view, courtesy of eFXnews:

Morgan Stanley booked a +400-pip profit today on its short EUR/USD position from 1.16.Expecting further EUR/USD decline and acting on its strategy to sell rebounds from here, MS also added a fresh limit order in its strategic portfolio to sell EUR/USD rebounds into 1.15.

The following are the detailed rationale behind this call along with the levels of the trade (entry, stop, and target) and its potential risk.

Powerful QE:

“The ECB’s decision to expand its asset-purchase program keeps us bearish on the EUR. EUR is swiftly losing support among reserve managers while cross-border investors with European exposure are being paid to hedge the FX. With the long-awaited sovereign QE announcement finally coming through and political risks not going away, EUR/USD could well approach parity,” MS projects.

…But Not Just QE.

“However, our bearish EUR view is not just about QE. We have made the case that the EUR is set to weaken as a result of previously announced monetary policy measures from the ECB, which have already had an impact. We have highlighted three main channels for EUR weakness: portfolio outflows, the use of the EUR as a funding currency and central bank reserve reallocation. There is evidence that all three channels have already been exerting downward pressure on the EUR,” MS clarifies.

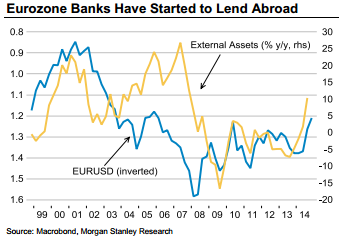

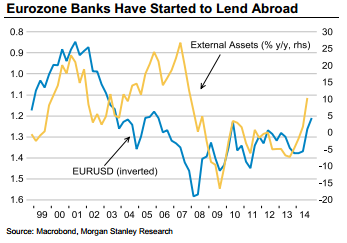

“Negative rates and yields have been forcing investors out of European assets and sovereign QE is now set to add to that pressure. European banks’ overseas lending has been picking up, while foreign corporates, especially US corporates, are issuing in EURs, implying that the EUR is being used as a funding currency for both portfolio and business investment,” MS notes.

“Meanwhile, the latest data from the IMF shows that central banks, especially in EM, have been significant net sellers of EUR, reducing the weighting of EURs in their FX reserves. These represent a significant structural outflow from EMU, likely keeping the EUR under significant pressure over the longer term. The addition of QE from the ECB will exacerbate these outflows, we believe, reinforcing the EUR bearish trend, hence our below consensus forecast for EUR/USD,” MS adds.

The Trade:

MS added a limit order in its strategic portfolio to sell EUR/USD at 1.15, with a stop at 1.1650, and a target at 1.0900.

Risks:

‘The key risk to this view would be a meaningful growth surprise in Europe and disappointment in the US. The risk to our bearish EUR view is not a slight EMU growth pickup, in our view. The risks are more likely to come from EMU relaxing fiscal consolidation temporally increasing EMU capital demand, or a shock to the banking sector making banks look inward again,” MS clarifies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.