EUR/USD dropped quite a lot and already reached a first major target. Can it continue lower? It faces significant support.

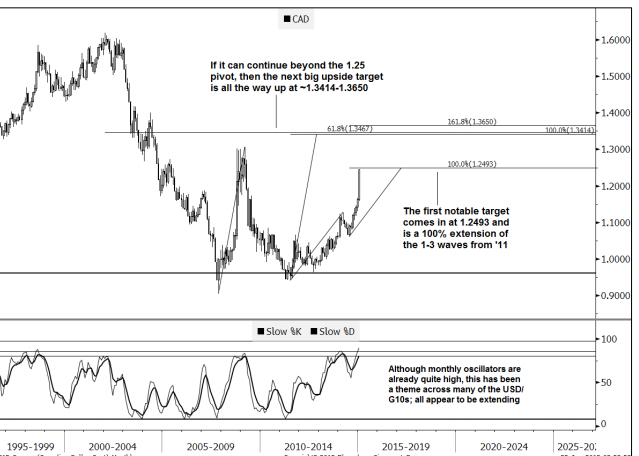

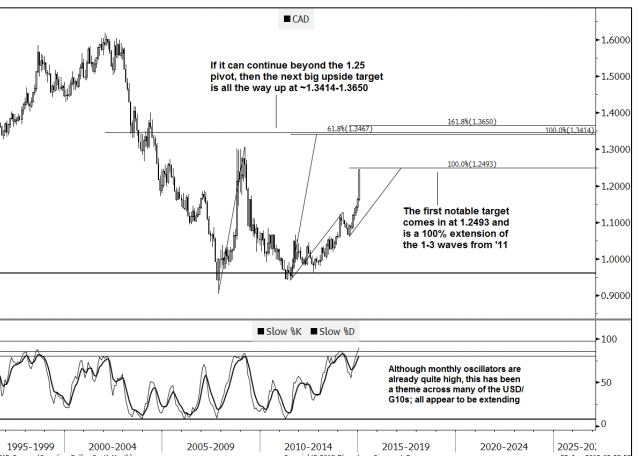

Also the Canadian dollar lost a lot of ground against the greenback. 1.25 could be the floodgate line to the next higher levels on USD/CAD.

Here is their view, courtesy of eFXnews:

EUR/USD has now reached its core ~1.12 target which in some way the first major target particularly from an Elliott Wave perspective, as it could theoretically complete/ satisfy the multi-year ABC correction that began back in ’08, notes Goldman Sachs.

“It’s certainly possible to extend this C-leg, but sensibly speaking, it’s really important now more than ever to watch for signs of momentum loss,” GS warns.

In terms of what’s next below 1.12, GS think that 1.10 is going to be psychologically significant and esides that, there’s really nothing which stands out as being particularly strong until ~1.0286-1.0103.

“While that might sound extreme, it’s clearly an important pivot from a pure techs perspective as it includes an ABC from the ‘08 high and also 76.4% retrace from ’01 (while still fitting with the LT wave count). All in all, it’s clear this trend could eventually extend much further,” GS adds.

Turning to USD/CAD, GS notes that it seems it’s very quickly headed above 1.25.

“In terms of resistance, there’s really nothing until the late -‘08/early-’09 highs up at 1.3017-1.3065. Even more significant is the area from 1.3414 to 1.3650,” GS adds.

“This region includes three main pivots; i) a 100% extension target taken from the Nov. ’07 low, ii) 61.8% retrace of the entire ‘02/’07 decline and iii) a 1.618 extension target from ’11 (derived in a similar manner to the 1.25 level described on the previous slide). It’s also a target which is another ~8% from current levels (again, like the rest of the G10/USD complex),” GS projects.

“In short, if ~1.25 doesn’t turn out to be the top of wave 5, then 1.35-1.36 is the likely the next “ideal” level to be looking at,” GS argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.